Managing money often feels like a juggling act. You have money coming in, bills going out, unexpected car repairs popping up, and the vague hope that you’re saving enough for a vacation next summer. When all of this activity happens in a single checking account, it’s a recipe for stress. You look at your balance, see a healthy number, and buy that expensive jacket—only to realize three days later that the mortgage payment hasn’t cleared yet.

The solution isn’t more willpower; it’s better infrastructure.

Based on the “5 Bank Accounts You Need” philosophy, this guide will walk you through a transformative way to organize your finances. By compartmentalizing your money into five distinct “buckets,” you give every dollar a job before it even hits your wallet.

1. Stop Budgeting by Accident: The Case for Structure

Most people practice “balance budgeting.” They check their bank app, see what’s there, and spend accordingly. The problem is that a bank balance is a liar. It doesn’t tell you that $200 of that balance is needed for the electric bill next week, or that you should be saving $50 a month for Christmas gifts.

Structure creates freedom. When you know your bills are covered in one account, you can spend the money in your “fun” account with zero guilt. This system moves you from reactive banking (putting out fires) to proactive banking (building a fortress).

2. The “One Pot” Problem: Why Single-Account Banking Fails

Imagine a restaurant that keeps its cash register money, its payroll money, and its food supply budget all in one big pile on the floor. It would be chaos. Yet, that is how most personal finances are run.

When you mix your mortgage money with your latte money, you create financial fog. You can’t see where you stand. The “One Pot” method relies entirely on your memory and mental math to ensure you don’t overspend. The 5-Account System removes the need for mental math.

3. Visualizing the Flow: Understanding the 5-Account Ecosystem

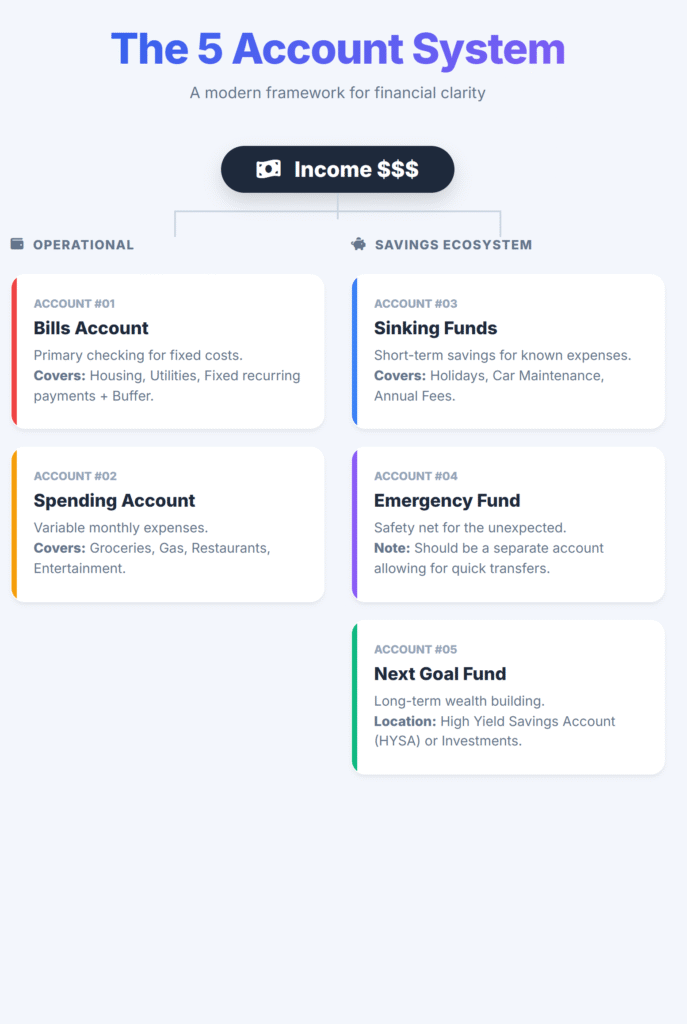

As illustrated in the diagram, think of your income ($$$$) as a river. When that river flows into your financial life, it shouldn’t just pool in one lake. It needs to be diverted into specific canals.

The flow works like this:

- Income arrives.

- Split 1: Essential survival money goes to Account #1.

- Split 2: Daily living money goes to Account #2.

- Split 3: The remainder flows downstream to your Savings ecosystem, where it is further divided into Sinking Funds (#3), Emergencies (#4), and Future Goals (#5).

4. The Income Trigger: How to Route Your Paycheck

To make this realistic, you need to change how you get paid. If you have Direct Deposit, ask your HR department if you can split your paycheck. Most payroll systems allow you to send a specific percentage or dollar amount to different accounts.

If you cannot split it at the source, you must set up an automatic transfer scheduled for the day after payday. The goal is to separate the money before you have a chance to see it or spend it.

5. Account #1: The Iron Wall for Fixed Expenses (The Bills Account)

What Goes Here?

This is the boring, unsexy, essential backbone of your life. This account is for fixed expenses that come out on a regular schedule.

- Mortgage/Rent

- Utilities (Electricity, Water, Internet)

- Insurance premiums

- Car payments

- Subscriptions (Netflix, Gym)

The Strategy

Do not carry a debit card for this account in your wallet. This account is a “pass-through” entity. Money comes in, and auto-pay bills take it out. You should rarely need to interact with this account manually.

6. The Critical “Buffer”: Why You Need Padding in Bill Pay

The diagram explicitly mentions a “+ Buffer” for the Bills Account. This is crucial advice.

If your total fixed monthly bills are $2,000, do not keep exactly $2,000 in this account. Fluctuation happens. Maybe it was a hot summer and the AC bill is higher, or a billing cycle shifted by a day.

The Rule: Keep one full month of expenses (or at least a $500–$1,000 cushion) in this account at all times. This prevents overdraft fees and ensures that if a paycheck is late, your lights stay on.

7. Account #2: The Spending Account

What Goes Here?

This is your “walking around” money. It is for variable expenses that require you to swipe a card or hand over cash.

- Groceries

- Gas/Transportation

- Restaurants & Coffee

- Entertainment

- Personal care (haircuts, toiletries)

The Psychology

This account represents your lifestyle cap. If you budget $800 a month for spending and you blow $400 on a fancy dinner in week one, you only have $400 left for groceries and gas. This account forces you to make real-time trade-offs without endangering your mortgage (which is safe back in Account #1).

8. Groceries, Gas, and Guilt-Free Dining

Many people ask, “Why aren’t groceries in the Bills account?”

Groceries are essential, but they are variable. You can choose to eat steak or you can choose to eat rice and beans. You cannot choose to pay half your rent. Because you have control over the amount spent on groceries and gas, they belong in the Spending Account where you can actively manage the budget week-to-week.

9. The Great Divide: Separating “Must-Haves” from “Nice-to-Haves”

The primary separation between Account #1 (Bills) and Account #2 (Spending) is the difference between keeping your life running and living your life.

- Account #1 protects your credit score and your shelter.

- Account #2 facilitates your daily habits.

By separating them, you ensure that a wild weekend of spending never results in a bounced electric bill check.

10. Moving Downstream: The Savings Junction

Once your immediate present is taken care of (Bills and Spending), the rest of your income flows to the “Savings Accounts.” In the diagram, this isn’t just one savings account; it splits into three distinct purposes.

This is where you stop living paycheck-to-paycheck and start building financial resilience.

11. Account #3: Sinking Funds

What is a Sinking Fund?

A sinking fund is a strategic way to save for a known future expense. Unlike an emergency fund (which is for surprises), a sinking fund is for things you know are coming, you just don’t know exactly when or how much.

Why You Need It

Without this account, every Christmas feels like a financial emergency. Every car oil change feels like a crisis. Account #3 smoothes out the bumpy road of life expenses.

12. Holidays, Maintenance, & Misc: Planning for the Predictable Unpredictables

What specifically goes into Account #3?

- Holidays: Christmas, birthdays, anniversaries.

- Car Maintenance: Tires, oil changes, registration fees.

- Home Maintenance: Lawn care, fixing a leaky faucet, annual pest control.

- Medical: Co-pays, dental cleanings (if not covered).

- Pet Care: Annual vet visits.

You should contribute a set amount here every month. For example, if you spend $1,200 on Christmas, you should be putting $100/month into this account all year long.

13. Account #4: The Emergency Fund Lifeline

The Definition

This account is strictly for unplanned, urgent, and necessary events.

- Job loss.

- Medical emergency.

- Major car breakdown (transmission failure, not just tires).

- Sudden home repair (flooded basement).

The “Quick Transfer” Rule

The diagram notes this is an “Account for Quick Transfer.” This means it needs to be liquid. Do not lock this money in a 5-year CD or invest it in the stock market where it could lose value. It should be in a standard savings or money market account linked to your main bank, so you can transfer funds to your checking account instantly if disaster strikes.

14. Liquidity Logistics: Why Access Matters

When you are standing at the mechanic shop and they demand $800 to release your car, you can’t wait 3 days for a bank transfer. Account #4 must be accessible. However, it shouldn’t be too accessible. Don’t attach a debit card to this account to avoid the temptation of “borrowing” from it for non-emergencies.

15. Account #5: The “Next Goal” Fund

The Dream Bucket

This is the most exciting account. This is where you save for the future you want, not just the expenses you have to pay.

- Down payment for a house.

- A new car (paid in cash).

- A wedding.

- A dream vacation to Italy.

High Yield Account

The diagram suggests a “High Yield Account” (HYSA) for this fund. Since this money might sit for a year or two before being used, it should earn interest. Online banks often offer interest rates 10x or 20x higher than traditional brick-and-mortar banks.

16. Harnessing Interest: The Role of High-Yield Savings Accounts

Inflation eats away at your savings. An HYSA helps you fight back. If you are saving for a house down payment of $30,000, keeping it in a standard checking account with 0.01% interest is a waste. In an HYSA at 4% or 5%, that money is working for you, generating passive income simply by sitting there.

17. Automation Architecture: Putting Your Money on Autopilot

The beauty of this system is that it relies on computers, not willpower. Here is the automation checklist:

- Payday: Income hits Account #1 (or splits at payroll).

- Day +1: Scheduled transfer moves “Spending Money” to Account #2.

- Day +1: Scheduled transfer moves “Sinking Fund” money to Account #3.

- Day +1: Scheduled transfer moves “Savings” to Accounts #4 and #5.

- Throughout Month: Bills auto-pay from Account #1. You spend from Account #2.

You only need to “manage” your spending in Account #2. The rest happens while you sleep.

18. Overcoming Friction: Managing Five Accounts Without Losing Your Mind

“Isn’t 5 accounts too many to track?”

Not if you use a dashboard. Tools like Mint, YNAB (You Need A Budget), or even your bank’s own app can usually view external accounts.

Pro Tip: Keep Account #1 and #2 at the same bank for instant transfers. Keep Accounts #3, #4, and #5 at a different bank (preferably an online HYSA). This “out of sight, out of mind” separation prevents you from raiding your savings for impulse purchases.

19. Adapting the System for Irregular Income Streams

If you are a freelancer or commission-based worker, this system is even more critical, but the flow changes slightly.

Instead of funding everything immediately:

- All income goes to Account #1.

- Account #1 acts as a “holding tank.”

- You pay yourself a “salary” from Account #1 to the other accounts on the 1st of every month.

- In high-income months, the buffer in Account #1 grows.

- In low-income months, the buffer supplements the lower income to keep the system running.

20. Conclusion: Your Roadmap to Financial Serenity

The “5 Bank Accounts” system is not just about organizing money; it’s about organizing your mind. It acknowledges a fundamental human truth: We spend what we see.

By hiding your bill money, your emergency fund, and your future goals in separate buckets, you artificially create scarcity in your Spending Account. This forces you to live within your means regarding daily purchases, while subconsciously building wealth in the background.

Set it up once. Automate the transfers. Watch your savings grow. That is the path to financial peace of mind.