Money management often fails not because people don’t understand the math, but because they don’t understand the categories. When you swipe your card for a coffee, is that a “Need” because you are tired, or a “Want” because you like the taste? When you pay for Netflix, is that a utility or entertainment?

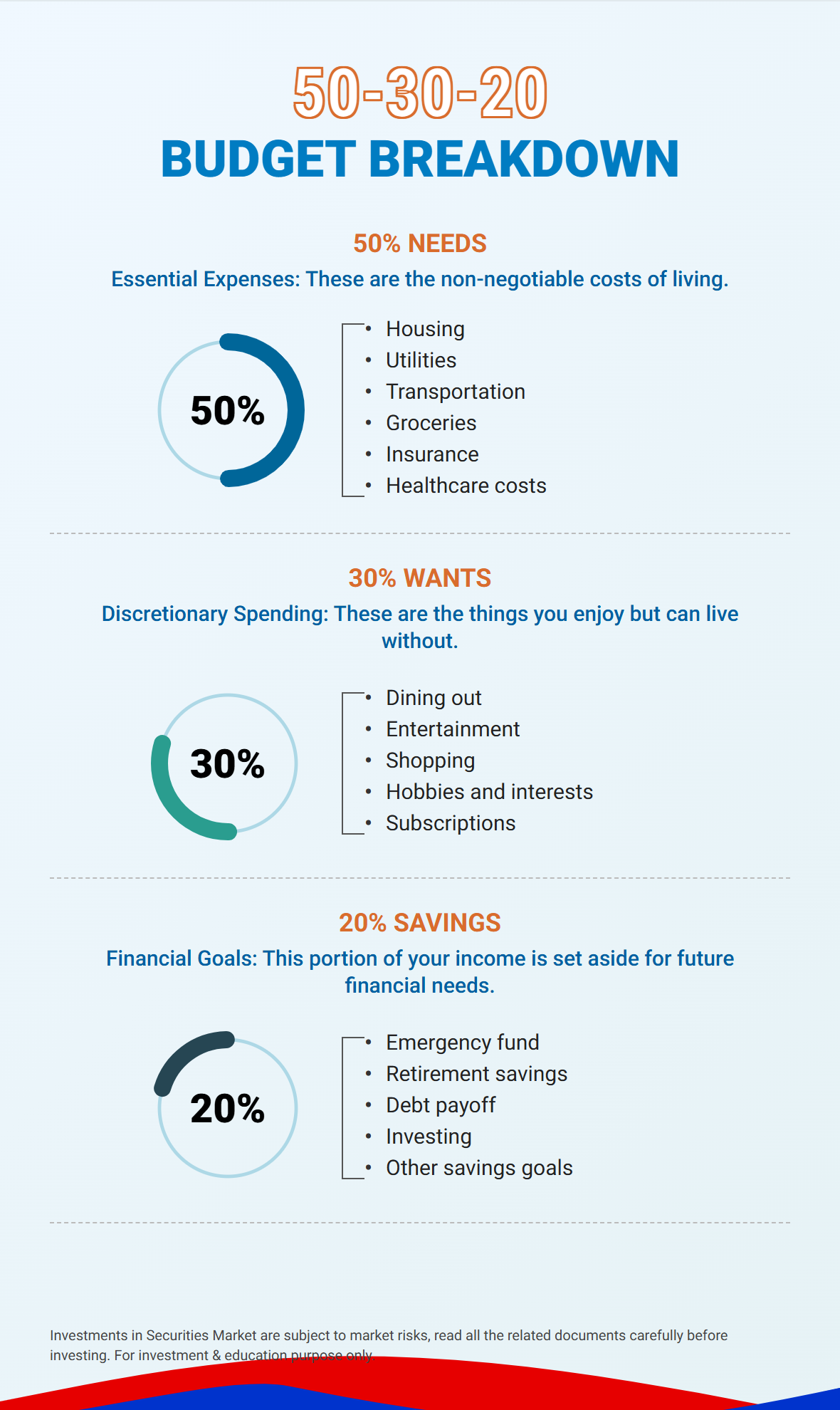

The infographic provided by Yes Securities offers a high-definition breakdown of the classic 50/30/20 rule. It moves beyond the broad concepts and lists specific line items that clog up modern bank statements—from healthcare costs to the ever-present subscriptions.

This guide dissects this breakdown, offering a manual on how to categorize, optimize, and execute each section of your financial life.

1. The Financial Triad: Balance, Not Deprivation

The graphic visualizes your income as three distinct gauges.

- 50% keeps your life running.

- 30% makes your life worth living.

- 20% secures your future life.

The genius of this specific breakdown is the explicit labeling. It defines Needs as “Non-negotiable,” Wants as “Can live without,” and Savings as “Future financial needs.” This linguistic shift is crucial. It stops you from lying to yourself about what is truly essential.

2. Decoding the “Essential”: The Non-Negotiable Test

To successfully stick to the blue 50% section, you must apply the “Non-Negotiable Test.” Ask yourself: If I lost my job today and had zero income, would I still be legally or physically required to pay this?

- Rent? Yes (or you get evicted).

- Electricity? Yes (or it gets cut off).

- Netflix? No.

- Gym Membership? No.

Only items that pass this test belong in the first bucket. If you cram “negotiable” items into the “non-negotiable” bucket, you will run out of room for savings.

3. The 50% Anchor: Managing Your Core Cost of Living

“Essential Expenses: These are the non-negotiable costs of living.”

If this bucket exceeds 50% of your take-home pay, you are in the “Danger Zone.” You have zero margin for error. If your car breaks down or your rent goes up, you will immediately slide into debt because you have no slack in the system.

If you calculate your expenses and find your Needs are at 65%, you have two choices:

- Earn more income (increasing the size of the pie).

- Make structural changes (moving to a cheaper apartment, selling a car). Cutting coupons won’t fix a structural problem.

4. Housing and Utilities: The Fixed Cost Trap

Listed in Image: “Housing” & “Utilities”

Housing is usually the largest single line item in a budget.

- The Trap: Many people qualify for a mortgage that costs 45% of their income. Just because the bank says you can afford it doesn’t mean you should.

- The Utility Variable: While rent is fixed, utilities are variable. This is an area where behavior changes (turning off lights, adjusting the thermostat, fixing leaks) can directly lower your “Needs” percentage, freeing up cash for the “Wants” bucket.

5. Transportation: The Variable that Masquerades as Fixed

Listed in Image: “Transportation”

This category includes more than just a car payment. It includes:

- Fuel / Charging costs

- Maintenance (oil changes, tires)

- Parking fees

- Public transit passes

- Registration taxes

The Optimization: Transportation is often the second biggest wealth destroyer after housing. Buying a reliable used car instead of leasing a new luxury vehicle can single-handedly fix a broken 50/30/20 budget.

6. Healthcare Costs: The Unpredictable Essential

Listed in Image: “Healthcare costs”

Unlike the previous generic infographic, this one explicitly lists Healthcare. In many countries, this is a massive, often unpredictable expense.

- Premiums: The monthly cost to have insurance.

- Out-of-Pocket: Co-pays, prescriptions, and deductibles.

Strategy: If you have high healthcare costs, they must come out of the 50% bucket. This might mean you only have 40% left for housing and food. You cannot ignore medical needs to preserve a luxury lifestyle.

7. Groceries: The Art of Nutritional Economics

Listed in Image: “Groceries”

Groceries are the most flexible part of the “Needs” bucket. You can spend $200 a month on rice and beans, or $1,000 a month on organic steaks. Both keep you alive.

- The Rule: If your 50% bucket is overflowing, “Groceries” is the first place to trim.

- The Distinction: Household items (cleaning supplies, toilet paper) count here. Alcohol and fancy snacks usually belong in the “Wants” category.

8. Insurance: The Expense That Protects All Other Expenses

Listed in Image: “Insurance”

This refers to Life, Auto, Home/Renters, and Disability insurance. Many young people skip Renter’s Insurance or Disability Insurance to save money. This is a mistake.

- The Logic: You pay a small premium to transfer a catastrophic risk to an insurance company.

- Budgeting Tip: If you pay insurance annually (to save money), divide the cost by 12 and set it aside monthly so the bill doesn’t surprise you.

9. The 30% Release Valve: The Psychology of “Wants”

“Discretionary Spending: These are the things you enjoy but can live without.”

The teal bucket is the fun bucket. It represents your “Standard of Living.” If you slash this to 0%, you will burn out and eventually “revenge spend.” You need to feed your psychological need for reward.

10. The Subscription Economy: Death by a Thousand Cuts

Listed in Image: “Subscriptions”

This is the defining financial challenge of the 2020s. Companies have moved to a “Subscription Model” because they know you will forget to cancel.

- The Audit: Check your bank statement. Netflix ($15), Spotify ($10), Amazon Prime ($15), iCloud ($3), Gym ($50), Apps ($5).

- The Reality: These seemingly small $10 charges can easily total $200+ a month.

- The Action: Rotate your subscriptions. Pay for Netflix for one month, watch everything you want, cancel it, and switch to Disney+. You don’t need to own all of them simultaneously.

11. Dining Out: Balancing Social Life with Solvency

Listed in Image: “Dining out”

Dining out is rarely just about food; it is about convenience and socializing.

- Convenience: Ordering Uber Eats because you are too tired to cook. (This is a “Want” that often masquerades as a “Need”).

- Socializing: Meeting friends for drinks or dinner.

- The Budget Trick: If you love dining out, you must sacrifice elsewhere in the 30% bucket. You can have expensive dinners OR expensive hobbies, but usually not both.

12. Hobbies and Interests: Budgeting for Passion

Listed in Image: “Hobbies and interests”

This is a broad category.

- Low Cost: Hiking, Reading (library), Writing, Gaming (if you already own the console).

- High Cost: Golf, Photography, Skiing, Car modification.

Your hobbies define your identity outside of work. The 30% bucket ensures you can fund these passions without guilt. If your hobby is expensive (e.g., photography gear), you save up for it within this bucket.

13. Shopping: Distinguishing Impulse from Intent

Listed in Image: “Shopping”

“Shopping” usually refers to clothing, gadgets, and home decor that are not strictly essential.

- The 24-Hour Rule: For any item over $50 in this category, wait 24 hours before buying. 80% of the time, the impulse will fade.

- Fast Fashion: Beware of buying cheap clothes constantly. It is often better to buy one high-quality item (Investment) than ten cheap ones that fall apart (Expense).

14. The 20% Growth Engine: Funding Your Future

“Financial Goals: This portion of your income is set aside for future financial needs.”

The bottom circle is the most critical for long-term freedom. The text explicitly mentions “Future financial needs.” This helps reframe savings—it’s not “losing” money today; it’s “sending” money to your future self.

15. The Emergency Fund: The Foundation of Risk Management

Listed in Image: “Emergency fund”

This is the first box to check.

- Why: If you lose your job, this fund moves up to the “50% Needs” bucket to pay your rent.

- Where: Keep this in a separate High-Yield Savings Account so you don’t accidentally spend it on “Dining out.”

16. Debt Payoff: The Guaranteed Return on Investment

Listed in Image: “Debt payoff”

Includes Credit Cards, Personal Loans, and Student Loans.

- The Math: If your credit card charges 18% interest, paying it off is a guaranteed 18% return on your money. No stock market investment can promise that risk-free.

- Priority: High-interest debt should usually be attacked before investing.

17. Retirement Savings: The Long Game

Listed in Image: “Retirement savings”

This refers to tax-advantaged accounts (like 401k or IRA in the US, EPF/PPF in India/others).

- Employer Match: If your company matches your contribution, this is “free money.” Always contribute at least enough to get the match. This comes out of the 20% bucket.

18. Investing: Taking Risk for Reward (The Securities Angle)

Listed in Image: “Investing”

Since this image is from Yes Securities, they highlight investing distinct from savings.

- Savings: Cash in the bank (Safe, low return).

- Investing: Stocks, Bonds, Mutual Funds (Volatile, higher return).

- The Warning: Note the disclaimer at the bottom: “Investments in Securities Market are subject to market risks.” This reinforces that the 20% bucket is not just for safety; it is for growth. You must accept risk to beat inflation.

19. “Other Savings Goals”: Preparing for Life’s Big Moments

Listed in Image: “Other savings goals”

This catch-all category is vital for avoiding debt. It includes:

- Wedding Fund: Weddings are expensive. Saving monthly prevents taking out a loan for the party.

- Down Payment: Saving for a house.

- New Car Fund: Saving cash to buy a car so you don’t have a monthly car payment (which lowers your 50% bucket expenses!).

20. Conclusion: Turning the Breakdown into a Breakthrough

The “Yes Securities” infographic provides a clear diagnostic tool.

- Step 1: Print your bank statement from last month.

- Step 2: Take three highlighters (Blue, Teal, Green).

- Step 3: Highlight every expense according to the list in the image.

- Step 4: Add them up.

You will likely find your percentages are off. You might be at 70/25/5. Do not panic. The 50/30/20 breakdown is the target, not the starting line. By identifying exactly which “Subscription” or “Dining Out” habit is blowing your budget, you can slowly recalibrate your spending until your financial picture aligns with this model of stability and growth.