If you ask the average person why they don’t invest in the stock market, you will almost always hear the same two excuses:

- “I don’t have enough money to start.”

- “I’m afraid I’ll buy at the wrong time and the market will crash.”

The second fear—the fear of timing—is what keeps millions of people on the sidelines, hoarding cash while inflation eats away at their savings. They stare at the stock charts, waiting for the “perfect dip,” paralyzed by the thought of buying at the top.

There is a cure for this paralysis. It is a strategy so simple that it is boring, yet so effective that it is used by the world’s most successful wealth builders.

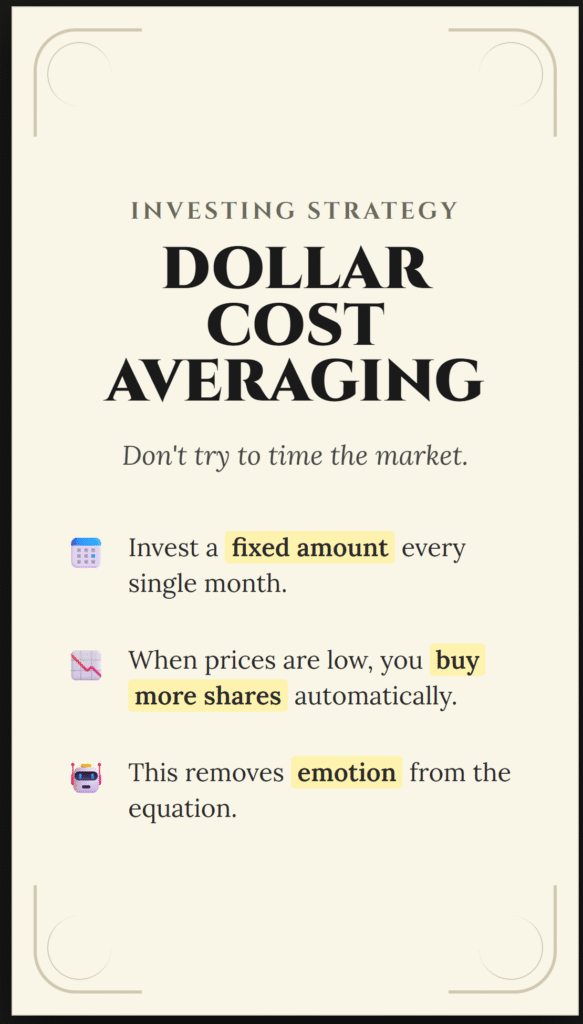

It is called Dollar Cost Averaging (DCA).

This guide will explain not just the mathematics of why it works, but the psychology of why it allows you to sleep at night while other investors panic. We will look at historical case studies of market crashes, compare DCA to “Lump Sum” investing, and show you exactly how to automate your path to wealth.

Part 1: What is Dollar Cost Averaging?

Dollar Cost Averaging is the practice of investing a fixed dollar amount into a specific investment at regular intervals, regardless of the share price.

It is the financial equivalent of putting your investment portfolio on autopilot.

How It Works

Instead of trying to save up $12,000 to invest all at once, you invest $1,000 on the 1st of every month for 12 months.

- Month 1: Stock price is $50. You buy 20 shares.

- Month 2: Stock price drops to $25. You buy 40 shares.

- Month 3: Stock price rises to $40. You buy 25 shares.

The Magic: Because you are investing a fixed amount of money, you automatically buy more shares when prices are low and fewer shares when prices are high.

You don’t have to predict the market. You don’t have to read the news. You just have to stick to the schedule. By doing this, you lower your “average cost per share” over time, ensuring that you never dump all your money in at the absolute peak.

Part 2: The Great Debate: Time in the Market vs. Timing the Market

To understand why DCA is so powerful, we must first dismantle the biggest myth in investing: the idea that you can outsmart the market.

The “Perfect Timing” Fantasy

Every investor dreams of buying Amazon at $5 in 2001 and selling it at $180 in 2021. In reality, trying to time these entry and exit points is a loser’s game.

Study after study has shown that “Market Timing” (jumping in and out of the market based on predictions) consistently underperforms a simple “Buy and Hold” strategy.

The Cost of Missing Out: According to data from JP Morgan and Bank of America, looking at the S&P 500 returns over a 20-30 year period:

- If you stayed fully invested the entire time, your returns were roughly 9-10% annually.

- If you tried to time the market and missed just the 10 best trading days (which often happen right after a crash), your returns are cut in half.

- If you missed the 30 best days, your returns might drop to near zero.

DCA solves this by ensuring you are always buying. You never miss a “best day” because you never leave the market.

The “Lump Sum” Math (The Counter-Argument)

Financial sticklers will often point out a mathematical truth: Lump Sum investing usually beats Dollar Cost Averaging.

If you have a windfall of $100,000 today:

- Math says: Invest it all today. Why? Because the market goes up more often than it goes down. Delaying your investment (DCA) means you are keeping cash on the sidelines while the market likely rises.

- Reality says: Are you psychologically strong enough to do that?

If you invest $100,000 today and the market drops 20% tomorrow, you have lost $20,000 in 24 hours. Most people will panic, sell at a loss, and never invest again. If you instead DCA that money over 12 months, and the market drops, you are happy because your next month’s payment buys more shares at a discount.

DCA is not about maximizing mathematical returns to the final decimal point. It is about maximizing behavioral compliance. It prevents you from panic-selling.

Part 3: The Psychology of Automation (Why It Works)

We are emotional creatures. We feel the pain of loss twice as intensely as the joy of gain (a concept known as Loss Aversion).

DCA hacks your brain to bypass these fears.

1. Eliminating “Regret Risk”

When you invest a lump sum, you constantly worry: “Did I buy at the top?” With DCA, you remove the possibility of making a single, catastrophic timing error.

- If the market goes up, you are happy because your account value is growing.

- If the market goes down, you are happy because you are buying “on sale.” By framing both outcomes as a “win,” you remove the stress.

2. Curing “Paralysis by Analysis”

New investors often spend months researching, waiting for the “perfect” moment to enter. They wait for the election to be over. Then they wait for the Fed meeting. Then they wait for earnings season. While they wait, the market often doubles. DCA removes the decision entirely. You don’t have to decide when to invest; the calendar decides for you.

3. Preventing “Revenge Trading”

When active traders lose money, they often make risky bets to “make it back.” This is how fortunes are lost. Automated DCA forces you to be disciplined. You cannot trade on impulse because the system is running without your input.

Part 4: Historical Case Studies (The Evidence)

Let’s look at how DCA protects you during the worst economic disasters in history.

Case Study 1: The “Lost Decade” (2000–2009)

The period from 2000 to 2009 is infamous. It began with the Dot-com crash and ended with the Global Financial Crisis (2008). If you looked at the S&P 500 price in Jan 2000 and compared it to Jan 2010, the market was actually down. It was a “lost decade” for price appreciation.

- The Lump Sum Investor: If you put $10,000 in at the peak of the Dot-com bubble (2000), ten years later you had less than $10,000. You lost money after a decade of waiting.

- The DCA Investor: If you invested $100 a month throughout that same chaotic decade, you made money.

Why? Because you kept buying during the crash of 2001, the stagnation of 2002-2007, and the massive crash of 2008. You scooped up shares at rock-bottom prices. When the market finally recovered in 2010-2013, you owned so many “cheap” shares that your portfolio exploded in value.

Case Study 2: The Great Recession (2008)

Imagine two investors in 2008.

- Unlucky Larry: Invests his life savings in October 2007, the exact market peak. By March 2009, his portfolio is down nearly 57%. He is devastated. It took him roughly 5 years just to break even.

- Steady Sarah: She started investing in October 2007 but used DCA. She bought at the peak, yes. But she also bought in 2008 when the market was down 20%, and she bought heavily in March 2009 at the absolute bottom.

Because Sarah lowered her average cost, she broke even roughly 2 years earlier than Larry. By the time Larry was just getting his money back, Sarah was sitting on significant profits.

Lesson: DCA turns market crashes from a “disaster” into an “accumulation opportunity.”

Part 5: The Trap of “Waiting for the Dip”

A common variation of market timing is “Hoarding Cash for the Crash.” You might think: “The market is too high right now. I’ll save my cash in a savings account and dump it all in when the market drops 20%.”

This sounds smart. Data proves it is disastrous.

The Problem:

- The Market might double before it drops. If the market is at 100, and you wait for a 20% drop (to 80), you might wait 3 years. In those 3 years, the market might go to 150. Even if it crashes 20% from 150, it only drops to 120. You were waiting to buy at 80, but the “crash price” is 120. You missed the boat completely.

- You won’t pull the trigger. Psychologically, when the market does crash 20%, it feels like the end of the world. The news is screaming “Depression!” and “Bankruptcy!” If you were too scared to buy when the market was calm, you will certainly be too scared to buy when the world is burning. You will likely wait for it to “stabilize,” and by then, the recovery has already happened.

DCA forces you to buy the dip automatically. You don’t need courage; you just need an automated bank transfer.

Part 6: How to execute a DCA Strategy

Ready to start? Here is the step-by-step playbook to implementing a stress-free investing life.

Step 1: Choose Your Vehicle

You need an investment account.

- 401(k) / 403(b): If you have a workplace retirement plan, you are already Dollar Cost Averaging. Money is taken out of every paycheck and invested. This is the purest form of DCA.

- Individual Retirement Account (IRA): Open a Roth or Traditional IRA.

- Brokerage Account: For money you might need before retirement.

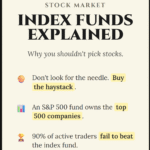

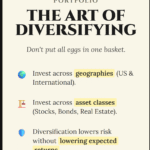

Step 2: Choose Your Asset

DCA works best with broad, diversified index funds (like an S&P 500 ETF or a Total World Stock Market Fund). Do not DCA into a single speculative penny stock. If that stock goes to zero, averaging down just means you lose more money. DCA requires an asset that will historically recover (like the total US economy).

Step 3: Automate the Transfer

This is the most critical step. Do not rely on your memory. Log into your bank or brokerage and set up an Automatic Investment Plan.

- Example: “Transfer $500 from Checking to Brokerage on the 15th of every month. Automatically buy Symbol: VOO.”

Once this is set, delete the app from your phone. Stop looking at it. Let the machine do the work.

Advanced Strategy: “Value Averaging”

For those who want a more complex version, there is Value Averaging. In this strategy, you adjust your contribution based on performance.

- If the market drops and your portfolio value falls behind target, you contribute more to catch up.

- If the market spikes and your portfolio is ahead of target, you contribute less (or even sell).

- Verdict: This mathematically outperforms DCA slightly, but it requires much more work and calculation. For 99% of people, simple DCA is better because it is easier to stick to.

Part 7: DCA in High-Volatility Assets (Crypto)

While this guide focuses on the stock market, DCA is perhaps even more essential for volatile assets like Bitcoin or Ethereum.

Crypto markets can swing 50% in a month.

- Lump Sum Risk: Buying Bitcoin at $69,000 in 2021 and watching it drop to $16,000 in 2022 is psychologically breaking. Most people sell at the bottom.

- DCA Defense: By investing $50 a week, you would have bought the top, but you also would have accumulated massive amounts during the $16,000 lows. Your average entry price would likely be profitable today, whereas the lump sum buyer is barely breaking even.

If you are going to invest in risky assets, DCA is the only safety harness you have.

Conclusion: The Tortoise Wins

In the fable of the Tortoise and the Hare, the Hare is faster, but he is erratic. He sprints, then naps, then gets distracted. The Tortoise just keeps stepping forward.

Lump Sum investing is the Hare. It can be faster, but it is prone to emotional naps and distractions. Dollar Cost Averaging is the Tortoise. It is relentless. It is disciplined. It is inevitable.

Investing is not about getting rich overnight. It is about getting rich over a lifetime. By removing the stress of timing, the fear of crashes, and the burden of decision-making, Dollar Cost Averaging clears the path for you to reach your financial goals.

Your Action Plan:

- Look at your budget and find a monthly number you can afford (even $50).

- Set up an automatic recurring transfer for that amount to your investment account.

- Go live your life. The math will handle the rest.