Buying a stock is easy. You press a button, and you own it. But understanding what you bought—and whether it will make you money—is the hard part. Many investors treat the stock market like a casino, betting on ticker symbols they heard about on social media.

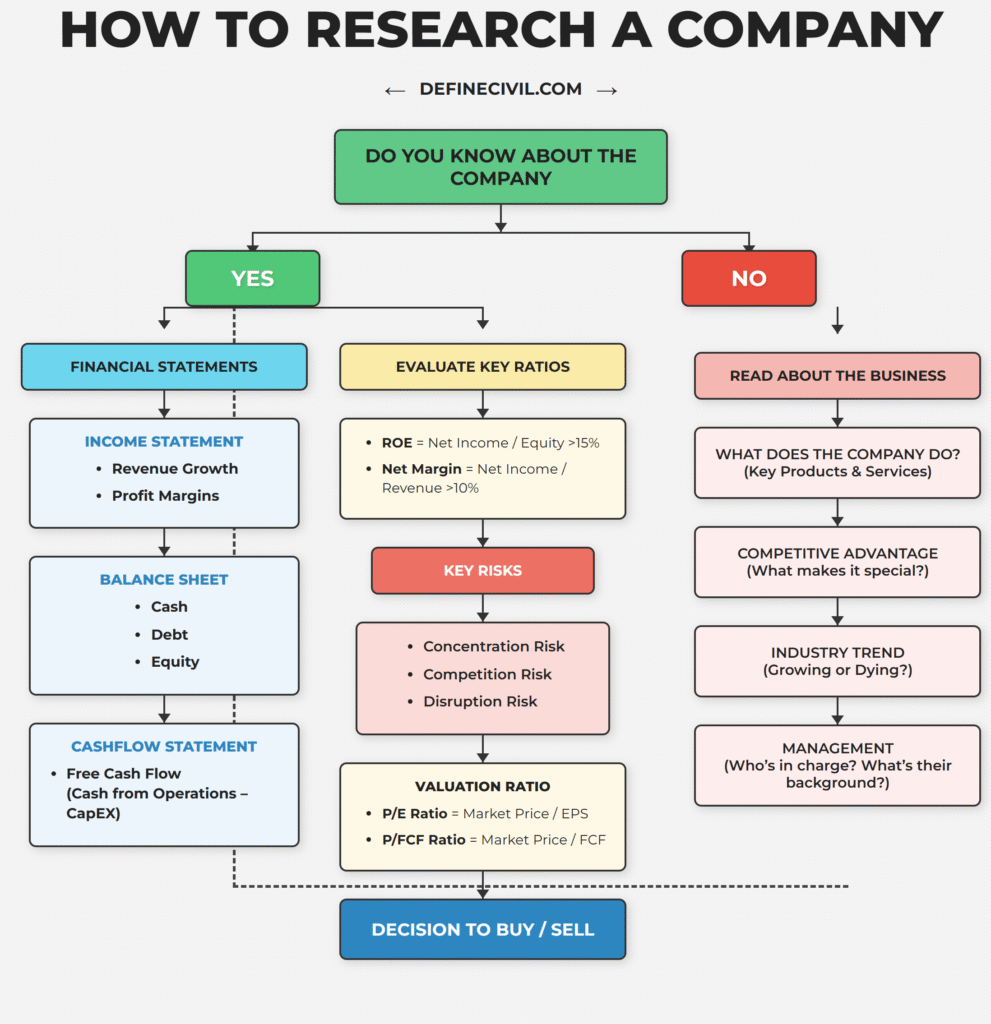

True wealth is built by treating stocks for what they truly are: partial ownership in real businesses. The infographic provided, designed by Brian Feroldi, outlines a systematic, logic-driven approach to researching a company. It divides the process into two distinct hemispheres: the Qualitative (the story) and the Quantitative (the numbers).

This guide expands that flowchart into a full curriculum for analyzing any potential investment.

1. Introduction: Stop Gambling, Start Researching

The biggest mistake new investors make is looking at the stock price first. The price tells you what the market thinks the company is worth right now, but it tells you nothing about the company’s health.

The flowchart begins with a simple question: “Do you know about the company?”

If the answer is NO, you cannot look at the numbers yet. Numbers without context are meaningless. You must start with the qualitative research. If the answer is YES, you proceed to the financial verification.

2. The Feroldi Framework: A Binary Decision Tree

The genius of this system is its linearity. You do not check the P/E ratio (Valuation) before you know what the company sells. You do not check the debt load (Balance Sheet) before you know if the industry is dying.

The process is a funnel. You start with thousands of potential companies.

- The Qualitative check filters out bad businesses.

- The Financial check filters out unprofitable businesses.

- The Valuation check filters out overpriced businesses.

Only the companies that survive all three filters deserve your capital.

Phase 1: The “No” Path — Understanding the Qualitative Narrative

If you stumble upon a stock ticker you don’t recognize, or a company you’ve only vaguely heard of, you enter the “No” path. This phase is about reading, listening, and learning. You are not using a calculator here; you are using common sense.

3. The Discovery Phase: Read About the Business

Before you look at a single chart, go to the company’s “Investor Relations” website. Download their latest Annual Report (10-K) or their most recent Investor Presentation. Read the “Business Overview” section.

If you cannot understand what the company does after reading their overview for 10 minutes, put it in the “Too Hard” pile and move on. As Warren Buffett says, “Never invest in a business you cannot understand.”

4. Decoding the Business Model: How Do They Actually Make Money?

“What does the company do? (Key Products & Services)”

You need to identify the “Revenue Driver.”

- McDonald’s: Sells fast food and owns real estate.

- Netflix: Sells subscriptions.

- Google: Sells advertising space.

Ask yourself: Is this product a need or a want? Is it recurring revenue (subscription) or one-off transactional revenue? Recurring revenue is generally superior because it provides predictable cash flow.

5. The Economic Moat: Identifying Competitive Advantages

“Competitive Advantage (What makes it special?)”

In capitalism, if a company makes a lot of money, competitors will try to steal their profits. A “Moat” is a barrier that protects the company from competitors.

Look for at least one of these moats:

- Network Effect: The service gets better as more people use it (e.g., Meta/Facebook, Visa).

- Switching Costs: It is too painful or expensive to switch to a competitor (e.g., Switching from Adobe Photoshop to a new software).

- Brand: People pay more just for the logo (e.g., Coca-Cola, Nike).

- Cost Advantage: They can sell it cheaper than anyone else and still make a profit (e.g., Costco).

If a company has no moat, it will eventually be crushed by competition.

6. Riding the Wave: Analyzing Industry Trends

“Industry Trend (Growing or Dying?)”

A great management team cannot save a company in a dying industry. You want to invest in companies with “Tailwinds” (factors pushing them forward) rather than “Headwinds” (factors pushing them back).

- Dying Trend: Cable TV, Coal, Department Stores.

- Growing Trend: Cloud Computing, Cybersecurity, Clean Energy, Aging Population Healthcare.

As the image suggests, ask yourself: Is this industry growing or dying? If the industry is shrinking, the company has to fight twice as hard just to stay the same size.

7. The Jockey Strategy: Assessing Management Quality

“Management (Who’s in charge? What’s their background?)”

You are giving your money to strangers to manage. Who are they?

- Founder-Led: Studies show that founder-led companies often outperform. Founders view the business as their life’s work, not just a job.

- Skin in the Game: Does the CEO own a lot of stock? You want them to get rich only when you get rich. If they are selling their stock while telling you to buy, run away.

- Glassdoor Ratings: Check employee reviews. If the employees hate the CEO, the culture is likely toxic, and talent will leave.

Phase 2: The “Yes” Path — The Quantitative Deep Dive

Once you understand the story and you like it, you move to the left side of the chart: The Numbers. This is where you verify if the story matches the reality.

8. The Three Pillars of Financial Truth

The infographic highlights three key documents found in every quarterly report:

- Income Statement: How much did they earn?

- Balance Sheet: What do they own and owe?

- Cash Flow Statement: Did the cash actually hit the bank account?

9. The Income Statement: Assessing Growth and Margins

“Revenue Growth & Profit Margins”

- Revenue (Top Line): Is it growing? A growth stock should be growing revenue by at least 10-15% annually. If revenue is flat, the company is stagnant.

- Gross Margin: (Revenue minus Cost of Goods Sold). A high gross margin (over 40%) usually indicates a strong competitive advantage or a premium product.

10. The Balance Sheet: Measuring Financial Fortitude

“Cash, Debt, Equity”

The Balance Sheet is a snapshot of the company’s health at a specific moment in time.

- Cash is Oxygen: You want to see a pile of cash. It allows the company to survive recessions, buy competitors, and pay dividends.

- Debt is Vulnerability: Look at “Long Term Debt.” If a company has more debt than assets, or if they cannot pay the interest on their debt using their operating income, they are at risk of bankruptcy.

11. The Cash Flow Statement: The Lifeblood of Survival

“Free Cash Flow (Cash from Operations – CapEx)”

This is often the most important, yet most overlooked, statement. A company can show a “Profit” on the Income Statement but still go bankrupt if they have no cash. This happens because of accounting tricks (like recognizing revenue before getting paid).

The Cash Flow statement tracks actual dollar bills moving in and out. You want to see “Cash from Operations” consistently rising.

12. Calculating Free Cash Flow: The Metric That Matters Most

The infographic explicitly highlights the formula:

$$Free Cash Flow (FCF) = Cash From Operations – Capital Expenditures (CapEx)$$

- Cash from Operations: Money made from the core business.

- CapEx: Money spent on new factories, computers, or buildings.

FCF is the “excess” cash left over after the bills are paid and the business is maintained. This is the money that can be returned to shareholders via dividends or buybacks. Positive and growing FCF is the holy grail.

13. The Efficiency Test: Why ROE > 15% is the Magic Number

“Evaluate Key Ratios: ROE > 15%”

Return on Equity (ROE) measures how efficiently a management team uses shareholder money.

$$ROE = \frac{\text{Net Income}}{\text{Shareholder Equity}}$$

If you give a CEO $100 million and they make $2 million profit (2% ROE), you would be better off putting that money in a savings account.

The infographic sets the benchmark at 15%. Companies that consistently sustain an ROE above 15% are usually high-quality compounders.

14. The Profitability Test: Demanding Net Margins > 10%

“Net Margin = Net Income / Revenue > 10%”

For every dollar the company brings in, how many cents do they keep?

- Grocery stores often have margins of 1-2%. (Very hard business).

- Software companies often have margins of 20-30%. (Very good business).

A Net Margin above 10% suggests the company has pricing power—they don’t have to compete strictly on price.

15. The Risk Audit: Three Ways a Company Dies

The chart features a red box labeled “KEY RISKS.” No research is complete without asking: “How could I lose all my money?”

16. Concentration Risk: The Danger of the Single Customer

“Concentration Risk”

Does one customer account for 20% or more of the revenue?

- Example: A supplier that sells screens only to Apple.If Apple decides to switch suppliers, that company’s stock goes to zero overnight. You want a diversified customer base.

17. Disruption and Competition: The External Threats

“Competition Risk & Disruption Risk”

- Competition: Is a bigger rival lowering prices to bleed them out? (e.g., Walmart vs. Mom & Pop shops).

- Disruption: Is the technology becoming obsolete? (e.g., Blockbuster vs. Netflix).

- Tip: Always research the competitors of the stock you are buying. Sometimes the competitor is the better buy.

Phase 3: The Decision

18. Valuation: The Price You Pay vs. The Value You Get

The final yellow box is “VALUATION RATIO.” You can find a perfect company (great management, high margins, no debt), but if you pay too much for it, it is a bad investment.

“P/E Ratio = Market Price / EPS”

- This is the standard metric. It tells you how many years of earnings it takes to pay back your investment.

- Average Market P/E: Historically ~15-20.

- If a company has a P/E of 100, it must grow incredibly fast to justify the price.

“P/FCF Ratio = Market Price / FCF”

- Many experts (including Feroldi) prefer Price-to-Free-Cash-Flow over P/E. Earnings can be manipulated; Cash Flow is harder to fake.

- A lower P/FCF is generally better, but “Quality” stocks usually trade at a premium.

19. The Final Verdict: Buy, Sell, or Watch

The arrow points to the blue box: “DECISION TO BUY / SELL.”

- The Strong Buy: Excellent Moat + Growing Industry + ROE > 15% + FCF Growth + Reasonable Valuation.

- The Watch List: Great company, but the Valuation (Price) is too high. Put it on a list and wait for a market crash or a dip to buy.

- The Pass: Fails the Qualitative test (bad industry) or the Quantitative test (low margins, high debt).

20. Conclusion: Executing Your Personal Financial Roadmap

Researching a company takes time. It might take 1 or 2 hours to go through this flowchart for a single stock. But considering that you worked hundreds of hours to earn the money you are investing, isn’t it worth spending two hours to protect it?

This flowchart by Brian Feroldi provides a disciplined filter. It removes emotion from the equation. By forcing every stock through this gauntlet of questions—checking the moat, the management, the margins, and the risks—you drastically reduce the chance of a blow-up and significantly increase the odds of finding a long-term winner.