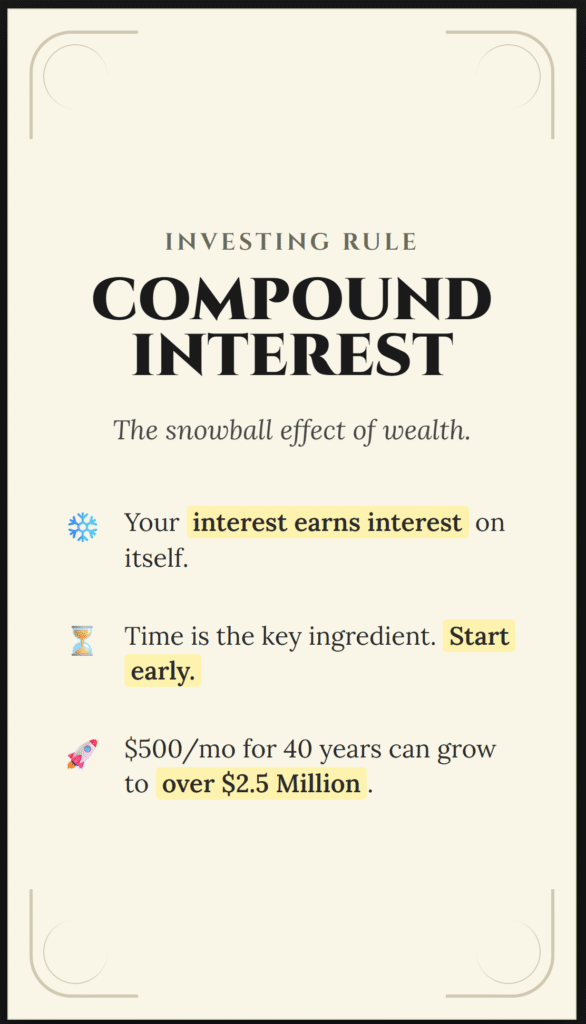

Albert Einstein is rumored to have said, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

Whether he actually said it or not, the math holds up.

Compound Interest is the engine that powers the global financial system. It is the reason why the rich get richer. It is the reason why a janitor can retire a millionaire, and why a high-income doctor can retire broke.

Most people understand “interest” in the simple sense: I lend you money, you pay me back a little extra. But Compound Interest is different. It is not just interest on your money; it is interest on your interest.

It is a snowball rolling down a hill. At the top, it is small and slow. You have to push it. But as it rolls, it picks up more snow. The surface area grows. It gets heavier. It moves faster. By the time it reaches the bottom of the hill, it is an unstoppable avalanche capable of crushing everything in its path.

This guide will move beyond the basic definition. We will break down the mechanics, prove the mathematical supremacy of starting early, and show you exactly how a 20-year-old can out-earn a 30-year-old while doing half the work.

Part 1: Linear vs. Exponential (The Mechanics)

To respect the power of compounding, you first have to understand how our brains are wired.

Human beings are evolved to think Linearly.

- If you take 30 steps, you travel 30 meters.

- If you work 10 hours, you get paid for 10 hours.

- Simple Interest is linear. If you invest $10,000 at 5% simple interest, you earn $500 every year.

- Year 1: $10,500

- Year 2: $11,000

- Year 3: $11,500

Wealth building, however, is Exponential.

- Compound Interest is exponential. You earn 5% on the $10,000, plus 5% on the $500 you earned last year.

- Year 1: $10,500 (Earned $500)

- Year 2: $11,025 (Earned $525)

- Year 3: $11,576 (Earned $551)

That extra $25 or $50 doesn’t look like much in the beginning. This is why people quit. They look at their savings account after two years and say, “This isn’t working.”

But they are looking at the flat part of the “Hockey Stick” curve. They haven’t reached the handle yet.

Part 2: The Tale of Two Investors (Age 20 vs. Age 30)

This is the most important case study in personal finance. It illustrates why Time is more important than Money.

Let’s meet two investors: Early Ella and Late Larry. Both investors earn an average 8% annual return (the historical average of the stock market). Both investors contribute $500 per month (roughly $6,000 per year).

The Scenario

1. Early Ella (The Sprinter)

- Starts at: Age 20.

- Stops at: Age 30.

- Ella invests diligently for 10 years. She puts in a total of $60,000.

- At age 30, she stops adding money completely. She never invests another dime. She just leaves the money in the account to grow until she retires at age 60.

2. Late Larry (The Marathon Runner)

- Starts at: Age 30.

- Stops at: Age 60.

- Larry parties through his 20s and doesn’t start until 30.

- He invests diligently for 30 years. He puts in a total of $180,000.

The Results (At Retirement Age 60)

Who has more money? Logic tells us it should be Larry. After all, he saved money for 30 years! He invested 3 times as much cash as Ella ($180k vs $60k).

Let’s look at the math.

| Investor | Cash Invested | Years Invested | Final Portfolio Value |

| Late Larry | $180,000 | 30 Years | $734,000 |

| Early Ella | $60,000 | 10 Years | $915,000 |

Shutterstock

Explore

The Analysis

Read that table again. Ella ended up with almost $200,000 MORE than Larry, despite investing $120,000 LESS.

How is this possible? Ella gave her money the one thing Larry couldn’t buy: Time. Ella’s money had 40 years to compound (from age 20 to 60). Larry’s money only had 30 years (from 30 to 60). Those first 10 years of Ella’s growth created a “base” so large that Larry could never catch up, no matter how hard he tried.

The Lesson: You cannot make up for lost time with more money. The most expensive thing you can spend is your 20s.

Part 3: The Penny Analogy (Understanding the “Explosion”)

If the Ella vs. Larry example didn’t convince you, let’s look at the “Penny Doubling” riddle. This illustrates the deceptive nature of exponential curves.

The Question: Would you rather have: A) $1,000,000 in cash right now? B) A Penny that doubles in value every day for 30 days?

Most people’s gut instinct says, “Give me the million!” Let’s trace the penny.

- Day 1: $0.01

- Day 5: $0.16 (This feels pathetic).

- Day 10: $5.12 (You are regretting your choice. You could have had a million).

- Day 20: $5,242.88 (You are still way behind. Only 10 days left).

This is the “Boring Middle.” You are 2/3rds of the way through the timeline, and you have barely 0.5% of the million dollars.

- Day 25: $167,772

- Day 28: $1,342,177 (Suddenly, you have passed the million).

- Day 29: $2,684,354

- Day 30: $5,368,709

The Result: The penny option is worth 5 times more than the cash option.

The Insight: Notice that all the magic happened in the last 3 days.

- On Day 29, you gained $2.6 million in a single day.

- That single day of growth was greater than the total value of the first 27 days combined.

This is exactly how retirement accounts work. You grind for 20 years and see slow progress. Then, in the last 10 years, your portfolio “explodes” upward. Most people quit on Day 20. They quit right before the explosion.

Part 4: The Three Levers of Compounding

There is a mathematical formula for compound interest:

A=P(1+r/n)nt

Don’t let the algebra scare you. It simply means your wealth is determined by three levers. You can pull any of them to get rich, but pulling all three is nuclear.

Lever 1: Principal (How much you save)

This is the fuel. If you start with $0, 8% growth on $0 is still $0. While you don’t need to be rich to start, you do need to feed the machine. Increasing your savings rate from 10% to 20% dramatically shortens your working career.

Lever 2: Rate of Return (How hard your money works)

This is the engine. This is why the Interest Rate matters.

- Savings Account (1%): Your money doubles every 72 years.

- Stock Market (8%): Your money doubles every 9 years.

- Great Investor (15%): Your money doubles every 5 years.

The difference between a 1% return and an 8% return over a lifetime is not 8 times more money. It is often 50 times more money. This is why you must invest, not just save.

Lever 3: Time (How long you wait)

This is the turbocharger. As proven by Ella and Larry, this is the most powerful lever. Time is an exponent in the equation. A small change in time creates a massive change in result.

- Delaying retirement by 5 years can often double your net worth.

- Starting 5 years earlier can cut the required monthly savings in half.

Part 5: The “Rule of 72” (A Quick Recall)

We covered this in Article 1, but it is worth repeating in the context of compounding. You don’t need a spreadsheet to estimate your future. Use the Rule of 72.

Divide 72 by your expected Interest Rate. The result is how many years it takes to double your money.

- At 8% return: 72÷8=9 years.

- At 12% return: 72÷12=6 years.

The “Doubling Game”: If you are 25 and invest $10,000 at 8% (doubling every 9 years).

- Age 34: $20,000

- Age 43: $40,000

- Age 52: $80,000

- Age 61: $160,000

- Age 70: $320,000

That single $10,000 investment turned into $320,000 without you adding another penny. That is the 8th Wonder of the World at work.

Part 6: The Dark Side (Compound Interest in Debt)

Compound interest is a double-edged sword. When you Invest, you are holding the handle. The sword cuts through financial obstacles. When you Borrow (credit cards), you are holding the blade. The sword cuts your hands.

Credit card debt is “Reverse Compounding.” Banks charge you 20-25% interest.

- Using the Rule of 72 (72÷24=3), your debt doubles every 3 years if left unchecked.

This is why credit card debt is a financial emergency. If you invest at 8% but owe money at 20%, you are losing the mathematical game. The “Negative Compounding” is overpowering the “Positive Compounding.” You must extinguish the negative fire before you can build the positive tower.

Part 7: Action Plan by Decade

Depending on where you are in life, your relationship with compound interest changes. Here is how to harness it right now.

In Your 20s: The “Golden Era”

You have the ultimate asset: Time.

- Strategy: Aggressive consistency.

- Goal: Invest anything. Even $50 a month.

- Mindset: Every $1 you spend on a trivial item today is $10 you are stealing from your future self. That $5 coffee isn’t $5; it’s $50 of retirement money.

In Your 30s: The “Messy Middle”

You likely have a mortgage, kids, and higher expenses. But you also have a higher salary.

- Strategy: Increase contributions.

- Goal: Try to max out tax-advantaged accounts (401k, Roth IRA).

- Mindset: You can still catch Ella, but you have to run harder. You cannot afford to take years off.

In Your 40s: The “Catch Up”

The compounding window is shortening. You have 20-25 years left.

- Strategy: High savings rate.

- Goal: You need to cut expenses and pour fuel on the fire. You can no longer rely solely on 8% returns to do the heavy lifting; you need to contribute significant Principal.

- Mindset: It is not too late. 20 years is still enough time for money to quadruple (double twice).

In Your 50s+: The “Preservation”

The snowball is huge. Now you need to make sure it doesn’t hit a tree.

- Strategy: Shift slightly to safety.

- Goal: Protect the principal.

- Mindset: You are no longer trying to get rich; you are trying to stay rich.

Conclusion: Planting the Tree

There is an old Chinese proverb: “The best time to plant a tree was 20 years ago. The second best time is today.”

Compound interest is a tree. If you had planted the seed at age 20 (like Ella), you would be sitting in the shade today. If you didn’t, you might feel regret. You might feel like it’s too late.

But looking at the math, you realize that the curve always goes up eventually. The only way to lose is to never plant the seed at all.

Don’t wait for a “lucky break.” Don’t wait for a “market crash.” Don’t wait for a “raise.”

Start the snowball today. Even if it is just a handful of snow. Push it. Keep pushing it. Eventually, gravity takes over, and the 8th Wonder of the World will carry you to financial freedom.