Everyone loves the idea of their investments growing, but calculating exactly how fast that growth happens usually requires a complex calculator or a spreadsheet.

Compound interest is powerful, but the math behind it is notoriously difficult to do in your head.

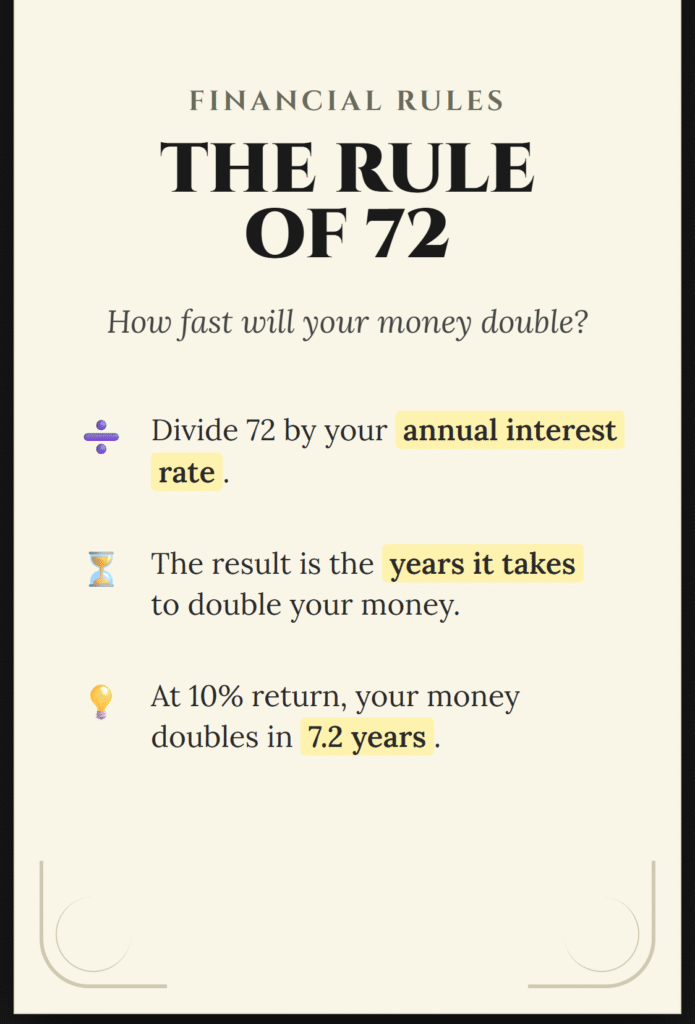

Enter The Rule of 72.

This simple mental math shortcut allows you to estimate exactly how long it will take for an investment to double in value, based on a fixed annual rate of return. It is one of the most vital concepts for investors to understand because it turns abstract percentages into a concrete timeline.

Here is how the formula works and how you can use it to plan your financial future.

What is the Rule of 72?

The Rule of 72 is a simplified formula that calculates the number of years it takes to double your money at a given interest rate.

While it is an approximation (not a precise down-to-the-penny calculation), it is remarkably accurate for the range of returns most investors deal with (typically between 3% and 15%).

The Formula

The math is incredibly straightforward. You simply divide the number 72 by your annual interest rate.

The Equation:

72÷Interest Rate=Years to Double

Important Note: When doing this calculation, do not convert the percentage to a decimal (e.g., do not use 0.08 for 8%). Use the whole number (8).

Real-World Examples

Let’s look at how this plays out with different rates of return. This highlights why chasing a slightly higher interest rate can make a massive difference in your timeline.

Example 1: The Average Stock Market Return (8%)

Let’s say you invest in a diversified portfolio that averages an 8% return annually.

- Math: 72÷8=9

- Result: It will take 9 years for your money to double.

Example 2: High-Yield Savings (4%)

You prefer a safer route and put your money in a high-yield savings account or government bonds yielding 4%.

- Math: 72÷4=18

- Result: It will take 18 years for your money to double.

Example 3: High Growth (12%)

You take on more risk and manage to secure a 12% average return.

- Math: 72÷12=6

- Result: It will take only 6 years for your money to double.

Flipping the Equation: Calculation for Goals

You can also use the Rule of 72 in reverse. If you know when you want your money to double, you can calculate the interest rate you need to find to make that happen.

The Equation:

72÷Years=Required Interest Rate

Scenario: You have $10,000 today and you need it to become $20,000 in 6 years for a down payment on a house. What interest rate do you need to hunt for?

- Math: 72÷6=12

- Result: You need to find an investment with a 12% return.

Why “72”?

You might be wondering, why 72? Why not 100?

Without getting too deep into the calculus, the number 72 is used because it is a convenient numerator that has many divisors (1, 2, 3, 4, 6, 8, 9, 12). Technically, the number 69.3 is more mathematically precise for natural logarithms, but 72 is much easier to do in your head and provides a “close enough” estimate for quick financial decision-making.

The Impact of Inflation

The Rule of 72 can also be used to calculate the “halving” of your money’s value due to inflation.

If inflation is running at 6%, you can divide 72 by 6. The answer is 12. This means that in 12 years, your money will buy half as much as it does today if you keep it under your mattress.

Summary

- The Rule: Divide 72 by your interest rate to find out how many years it takes to double your capital.

- The Usage: Use it to compare investments or set savings goals.

- The Caveat: It is an estimation, but it is accurate enough for personal finance planning.

Next time you see an investment promising a 6% return, you don’t need a calculator to know that your money will double in 12 years—you just need the Rule of 72.