When you ask people how much money they need to retire, they usually guess.

“One million dollars?” “Five million dollars?” “I’ll just work until I die.”

Retirement planning often feels like shooting in the dark. You are trying to solve a math problem where you don’t know the most important variable: How long you are going to live.

If you retire at 65 and die at 66, you don’t need much money. If you retire at 65 and live to 105, you need a fortune. The fear of running out of money (longevity risk) keeps millions of people chained to their desks years longer than necessary.

But what if there was a formula? A specific, back-tested mathematical rule that could tell you exactly when you have “enough”?

There is. It is called The 4% Rule.

This rule is the bedrock of the modern Financial Independence (FIRE) movement. In this guide, we will break down exactly how it works, where it came from, and how to use it to calculate your “Freedom Number.”

Part 1: The Origin Story (The Trinity Study)

In the old days, people didn’t worry about withdrawal rates. They had pensions. You worked for GM for 40 years, retired, and they sent you a check every month until you died.

Pensions are effectively dead. Now, we have 401(k)s and IRAs. You are responsible for saving a pile of money, and you are responsible for making it last.

In 1998, three professors at Trinity University (Texas) asked a simple question: “What is the safe withdrawal rate?” In other words: If you retire with a portfolio of stocks and bonds, what percentage can you withdraw every single year, adjust for inflation, and have a 95-100% chance of never running out of money over a 30-year retirement?

They ran the numbers through every market crash in history—the Great Depression, the stagflation of the 70s, the 1987 crash.

The Answer: 4%.

Part 2: How the Rule Works (The Mechanics)

The rule states that if you invest in a balanced portfolio (e.g., 50% stocks / 50% bonds or 75% stocks / 25% bonds), you can withdraw 4% of your initial portfolio value in the first year of retirement.

In subsequent years, you adjust that dollar amount for inflation.

The Example:

Let’s say you retire with $1,000,000.

- Year 1: You withdraw $40,000 (4% of $1M).

- Year 2: Inflation is 3%. You increase your withdrawal by 3%. You withdraw $41,200.

- Year 3: Inflation is 2%. You increase by 2%. You withdraw $42,024.

- … and so on for 30 years.

Even if the stock market crashes during your retirement, the history suggests that the growth in the good years will counterbalance the losses in the bad years, and your portfolio will survive.

Part 3: Finding Your “Freedom Number” (The Rule of 25)

The 4% Rule gives us a powerful shortcut to calculate exactly how much you need to save. Since 100 divided by 4 is 25, the math works in reverse.

Annual Expenses x 25 = Your FIRE Number.

You don’t need to guess. You just need to know what you spend.

- Scenario A (Lean): You spend $40,000 a year.

- $40,000 x 25 = $1,000,000 needed.

- Scenario B (Comfortable): You spend $60,000 a year.

- $60,000 x 25 = $1,500,000 needed.

- Scenario C (Fat FIRE): You spend $100,000 a year.

- $100,000 x 25 = $2,500,000 needed.

This is incredible news because it puts you in control. If you want to retire sooner, you have two levers:

- Save more money (increase the nest egg).

- Spend less money (decrease the target). Cutting your expenses by $10,000 a year reduces your required nest egg by $250,000.

Part 4: The Caveats (Is it Safe?)

Since the Trinity Study was published, economists have debated whether 4% is still safe in the modern era of lower bond yields and longer life expectancies.

1. The 30-Year Horizon

The study looked at a 30-year retirement (e.g., retiring at 65 and dying at 95). If you are planning to retire at 35 (Early Retirement), your money needs to last 50 or 60 years. For early retirees, many experts suggest a safer withdrawal rate of 3.5% or 3.25%.

- The Math: Expenses x 30 (instead of 25).

2. Sequence of Returns Risk

This is the biggest danger. Averages are misleading. The market might average 8% growth, but if the market crashes 40% the year after you retire, you are in trouble. You are selling stocks while they are down to pay your bills. This depletes your portfolio so fast that it can never recover, even when the market booms later.

- The Solution: Have a “Cash Tent” or “Bond Tent.” Keep 2-3 years of cash expenses in a high-yield savings account when you retire. If the market crashes, spend the cash. Don’t sell the stocks. Wait for the recovery.

3. Flexibility is Key

The Trinity Study assumed you were a robot—that you would blindly withdraw the inflation-adjusted amount even if the world was ending. In reality, you are human. If the market crashes 30%, you probably won’t take that lavish vacation to Europe this year. You will cut your spending. If you are flexible and can reduce your withdrawal to 3% during bad years, your success rate jumps to nearly 100%.

Part 5: The Role of Social Security

The 4% Rule calculation typically ignores Social Security. It assumes you are funding your life entirely from your portfolio. For most people, Social Security is a safety buffer. If you need $40,000/year and Social Security pays you $20,000/year (starting at age 67), your portfolio only needs to generate the other $20,000. This drastically reduces your FIRE number.

- Total Need: $40,000

- Social Security: -$20,000

- Portfolio Need: $20,000

- FIRE Number: $20,000 x 25 = $500,000 (instead of $1M).

Part 6: Inflation (The Silent Killer)

The 4% rule is designed specifically to fight inflation. Most people forget that $1 million in 2055 will not buy what $1 million buys today. Because the rule increases your withdrawal amount by the inflation rate every year, it preserves your Purchasing Power. This is why you must invest in stocks (equities). Cash and Bonds rarely beat inflation over the long term. You need the growth engine of the stock market to keep up with the rising cost of bread and milk.

Part 7: How to Start (The Path to FIRE)

You now have the target. How do you hit it?

- Track Your Spending: You cannot calculate your number if you don’t know your annual expenses. Track every penny for 3 months to get an accurate baseline.

- Calculate the Gap: Income – Expenses = The Gap.

- Invest the Gap: Put that money into low-cost Index Funds (Total Stock Market).

- Wait: Let compound interest do the heavy lifting.

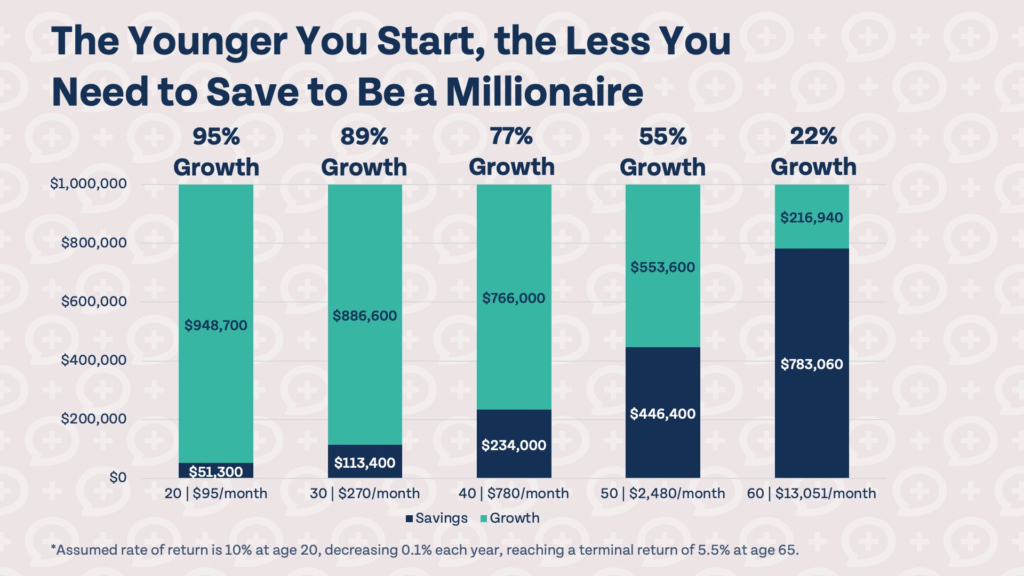

The “Coast FIRE” Milestone

There is a magical point called “Coast FIRE.” This is when you have saved enough money that, even if you never contribute another cent, compound interest will grow your pot to your FIRE number by age 65.

- Example: At age 30, you have $200,000. If that grows at 7% for 35 years, it becomes $2.1 million at age 65 without you adding anything.

- Once you hit Coast FIRE, you only need to earn enough money to cover your current bills. You can quit the high-stress job and work as a barista or park ranger, knowing your retirement is already secured.

Conclusion

The 4% Rule is not a guarantee. It is a compass.

It gives you a direction to sail. Without it, you are just saving blindly, hoping it will be enough. With it, you have a finish line. And the beautiful thing about a finish line is that once you see it, you run faster.

Calculate your number today. It might seem large, but it is finite. And every dollar you save is a step closer to owning your time.