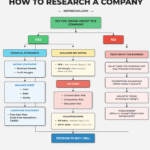

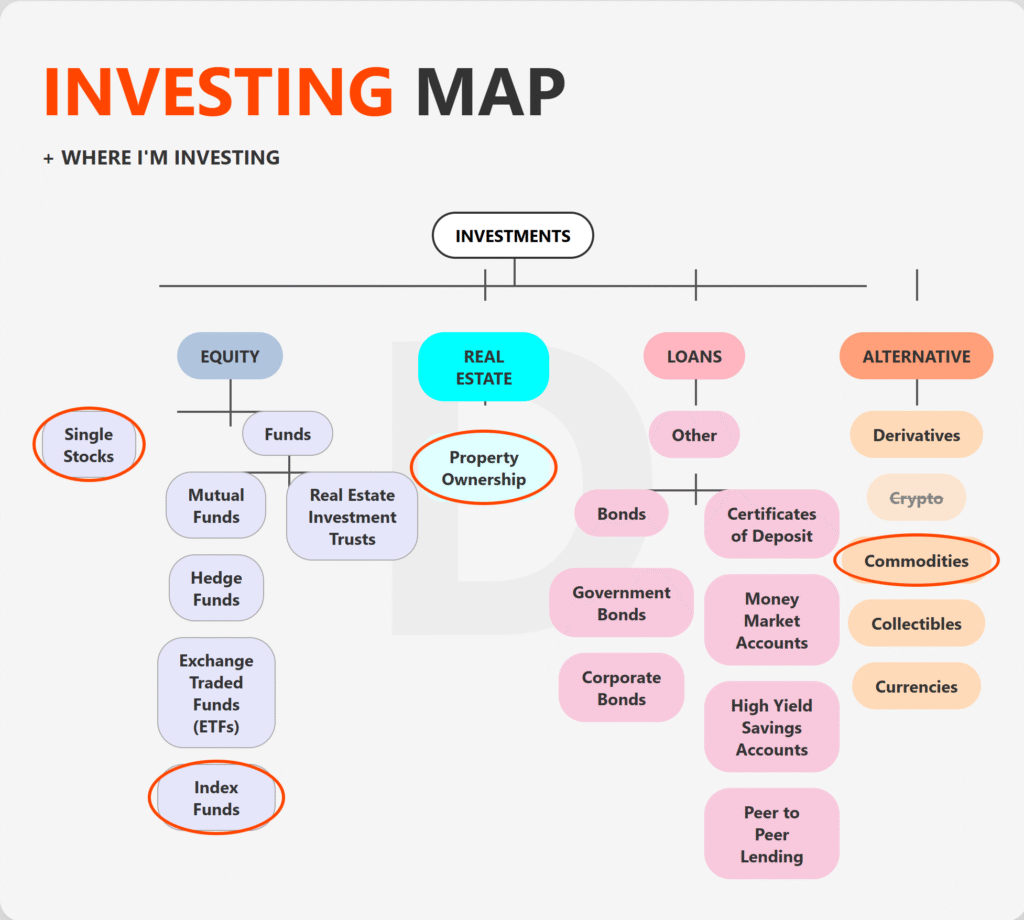

Investing can often feel like navigating a foreign city without a GPS. There are thousands of vehicles, jargon-heavy terms, and conflicting advice. The infographic provided—The Investing Map—is an essential tool for decluttering this chaos. It categorizes where money can go into four distinct kingdoms: Equity, Real Estate, Loans, and Alternatives.

More importantly, this map highlights a specific strategy (indicated by the orange circles). By analyzing both the full map and the specific choices made, we can construct a robust, realistic guide to building a portfolio that balances growth, safety, and tangible assets.

1. The Investing Map: A Bird’s Eye View of Wealth Creation

At the top of the hierarchy sits the word INVESTMENTS. To be an investor means you are no longer working for money; your money is working for you.

The map splits into four primary branches. A healthy portfolio usually contains exposure to at least three of these to ensure diversification.

- Equity: You own a piece of a company.

- Real Estate: You own physical land or buildings.

- Loans (Fixed Income): You lend money and get paid interest.

- Alternatives: You own non-traditional assets (Gold, Crypto, Art).

The specific strategy highlighted in the image is a “Core and Satellite” approach. It uses Index Funds and Property as the stable core, Single Stocks for aggressive growth, and Commodities as a hedge against inflation.

2. Equity: The Engine of Modern Wealth

The first and most popular branch is Equity. When you buy equity, you are buying a legal claim to a portion of a business’s future profits. Over the last century, equities have outperformed almost every other asset class, returning an average of roughly 10% annually.

This branch splits into two main paths: buying companies individually (Single Stocks) or buying them in bundles (Funds).

3. Single Stocks: The High-Stakes Game of Picking Winners (Circled)

One of the circled items in the image is Single Stocks. This is the most “active” form of equity investing.

When you buy a single stock (e.g., Apple, Tesla, or Coca-Cola), you are betting that this specific company will perform better than the market average.

Why choose Single Stocks?

- Alpha Generation: “Alpha” is the return you get above the market average. If you bought Nvidia five years ago, you crushed the market average. Index funds cannot give you 1000% returns in a few years; single stocks can.

- Voting Rights: You become a partial owner with a say in shareholder meetings.

- Dividends: You can target specific companies with high dividend yields to build a customized income stream.

4. The Risks and Rewards of Individual Company Ownership

However, the map implies a warning by placing this separately from funds. Single stock investing carries Idiosyncratic Risk—the risk specific to one company.

If you own 100% Amazon stock and Amazon faces an antitrust lawsuit, your wealth plummets. If you own an Index Fund containing Amazon, that lawsuit barely registers on your net worth.

The Strategy: Most financial experts recommend that Single Stocks make up no more than 5% to 10% of your total portfolio. They are the “fun” money or the “speculative” pot intended to boost returns, not the money you need for your mortgage.

5. Funds: The Basket Approach to Investing

Moving to the right of the Equity branch, we find Funds. This is where the vast majority of modern wealth is built. A fund is simply a pool of money from thousands of investors used to buy a basket of stocks.

The map lists several types:

- Mutual Funds: Actively managed by a professional (who charges a high fee) trying to beat the market.

- Hedge Funds: Exclusive, high-risk pools for wealthy investors.

- ETFs (Exchange Traded Funds): Funds that trade like stocks on the exchange.

But the most important one, and the one circled in the image, is the Index Fund.

6. Index Funds: The Ultimate Passive Strategy (Circled)

Index Funds are the “boring” hero of the investing world. Instead of trying to find the needle in the haystack (the one winning stock), an Index Fund buys the whole haystack.

Why it is circled (The Smart Choice):

- Diversification: A classic S&P 500 index fund buys the 500 biggest companies in America. If one goes bankrupt, you still have 499 others.

- Low Fees: Because there is no expensive fund manager guessing which stocks to buy (the computer just follows the list), the fees are near zero.

- Self-Cleansing: Index funds are “Darwinian.” If a company starts failing and drops out of the top 500, the fund automatically sells it and buys the new rising company replacing it. You always own the winners.

For 90% of investors, Index Funds should make up the majority of their Equity portfolio.

7. Mutual Funds vs. ETFs: Understanding the Vehicle

The map makes a distinction between Mutual Funds, ETFs, and Index Funds. It is important to note that these terms overlap.

- An Index Fund is a strategy (following a list).

- An ETF or Mutual Fund is the wrapper (how you buy it).

You can buy an S&P 500 Index Fund as an ETF (like VOO or SPY) or as a Mutual Fund (like VFIAX). The circled preference for “Index Funds” under the ETF branch suggests the user prefers the liquidity of ETFs—meaning they can trade them instantly during the day, unlike Mutual Funds which only price once at the end of the day.

8. Real Estate: The Tangible Asset Class

The second major pillar is Real Estate. This is the favorite asset class of the “old money” rich. Unlike stocks, which appear as numbers on a screen, Real Estate is something you can touch.

Real Estate offers a unique combination of benefits:

- Cash Flow: Monthly rent checks.

- Appreciation: The property value goes up.

- Tax Benefits: Depreciation write-offs.

9. Property Ownership: The Power of Leverage and Cash Flow (Circled)

The image circles Property Ownership. This refers to direct investment: buying a residential home, a duplex, or a commercial building.

The Superpower of Direct Ownership: Leverage. If you want to buy $100,000 of stocks, you need $100,000. If you want to buy a $500,000 house, you only need roughly $100,000 (a 20% down payment). The bank lends you the rest.

If that $500,000 house goes up in value by 10% ($50,000), your return on your actual cash ($100,000) is 50%. This is how real estate accelerates wealth. However, it is circled because it is also active work. You must deal with maintenance, tenants, and insurance. It is a business, not just an investment.

10. REITs: Real Estate for the Reluctant Landlord

Next to Property Ownership is Real Estate Investment Trusts (REITs). Think of a REIT as a “Mutual Fund for Real Estate.” You buy shares of a company that owns shopping malls, hospitals, or apartment complexes.

While not circled in this specific strategy, REITs are excellent for people who want real estate exposure but do not want to fix a leaking toilet at 2 AM. They are required by law to pay out 90% of their taxable income as dividends, making them great for cash flow.

11. The “Loans” Sector: Becoming the Banker

The pink section of the map is labeled LOANS. In finance, this is usually called “Fixed Income” or “Debt Instruments.”

Here, you are not an owner (Equity); you are a lender. You give money to a government, bank, or person, and they promise to pay it back with interest. This is generally safer than stocks but offers lower returns.

12. Bonds: Understanding Government and Corporate Debt

Government Bonds: You lend money to the government (e.g., US Treasuries). These are considered “risk-free” because the government can print money to pay you back. They are the ballast of a portfolio, providing stability when stocks crash.

Corporate Bonds: You lend money to a company (e.g., Microsoft or Ford). These pay higher interest than government bonds because there is a risk the company could go bust.

13. Cash Equivalents: CDs, Money Markets, and High-Yield Savings

The map lists Certificates of Deposit (CDs), Money Market Accounts, and High Yield Savings.

These are technically “loans” to the bank. The bank pays you interest (currently around 4-5% in decent economic climates) to use your money. This is where your Emergency Fund should live. It is not for wealth creation; it is for wealth preservation and liquidity.

14. Peer-to-Peer Lending: The Democratization of Debt

At the bottom of the Loans branch is Peer-to-Peer (P2P) Lending. Platforms like LendingClub or Prosper allow you to lend $25 to a guy named Steve who wants to renovate his kitchen.

You act as the bank. The returns can be high (8-10%), but the risk is also high—if Steve loses his job and defaults, you lose your money. It is a niche investment that fits between bonds and stocks in terms of risk profile.

15. Alternative Investments: The Wild West of Finance

The final branch is ALTERNATIVE. This includes everything that doesn’t fit into the traditional three categories. This sector is for sophisticated investors looking for non-correlated assets—meaning assets that don’t move in sync with the stock market.

16. Commodities: Hedging with Raw Materials (Circled)

The final circled item in the image is Commodities. Commodities are physical raw materials used to build the economy. They fall into three types:

- Energy: Oil, Natural Gas.

- Metals: Gold, Silver, Copper, Lithium.

- Agriculture: Wheat, Corn, Coffee, Livestock.

Why invest here? The investor who created this map likely chose commodities (specifically Gold or broad commodity ETFs) as a hedge against inflation. When inflation rises, the cost of goods goes up. If you own the goods (commodities), your portfolio value rises, offsetting the fact that your cash is worth less.

Gold, in particular, is viewed as “disaster insurance.” It tends to hold value when governments are unstable or currencies are failing.

17. Collectibles and Currencies: Art, Wine, and Forex

Collectibles: Investing in vintage cars, fine wine, watches, or Pokémon cards. This is a passion-based investment. It is illiquid (hard to sell quickly) and speculative.

Currencies (Forex): Betting on the fluctuation between the US Dollar, the Euro, the Yen, etc. This is highly volatile and usually dominated by professional day traders rather than long-term investors.

18. Derivatives and Crypto: Speculation vs. Investment

Derivatives: Options and Futures. These are contracts betting on the future price of an asset. They are financial weapons of mass destruction if used incorrectly, capable of wiping out a portfolio in minutes.

Crypto: Bitcoin, Ethereum, etc. While not fully circled, the circle around commodities grazes Crypto. Digital assets are the newest asset class. They offer “asymmetric upside” (small money can become huge money) but come with extreme volatility.

19. The “Selected” Portfolio: Analyzing the Circled Strategy

Let’s look at the four circles together to understand the psychological profile of this investor.

- Index Funds: The reliable engine. (40-60% of portfolio).

- Property Ownership: The leverage and cash flow booster. (20-30% of portfolio).

- Single Stocks: The aggressive play for higher returns. (10-15% of portfolio).

- Commodities: The safety valve against inflation. (5-10% of portfolio).

This is a balanced, all-weather portfolio. It acknowledges that:

- Market timing is hard (hence Index Funds).

- Leverage builds wealth (hence Real Estate).

- Picking winners is fun and profitable (hence Single Stocks).

- The economy might crash or inflation might spike (hence Commodities).

20. Conclusion: Drawing Your Own Map to Financial Freedom

The “Investing Map” serves as a menu. You do not need to order everything on the menu to be full. In fact, ordering everything leads to indigestion (over-diversification and complexity).

To use this map effectively:

- Start with Funds (Index Funds): Build your foundation here. It requires the least knowledge and offers the most consistent results.

- Add Fixed Income (Loans/Savings): Ensure you have a safety net in high-yield savings.

- Choose your “Kicker”: Once you have significant capital, decide if you want to be active (Property Ownership) or passive (REITs), or if you want to chase growth (Single Stocks) or safety (Gold/Commodities).

Investing is personal. The map provides the routes, but your goals determine the destination. The circled path in the image is a proven, robust road to millionaire status—combining the ease of indexing with the power of real estate and the protection of commodities.