Imagine walking on a tightrope.

It’s high up, the wind is blowing, and your balance is wavering. Now, imagine doing that same walk without a safety net underneath you. Every wobble is terrifying. Every gust of wind feels like a life-or-death situation.

This is exactly how millions of people live their financial lives. They live paycheck to paycheck, walking the tightrope, hoping that nothing goes wrong. But in life, “something” always goes wrong. The car breaks down. The roof leaks. The company downsizes.

An Emergency Fund is your financial safety net. It doesn’t stop the wind from blowing, but it ensures that when you fall, you bounce back instead of crashing.

This guide will explain exactly why you need one, how to calculate your “magic number” for total peace of mind, and the specific type of bank account you must use to keep your money safe and growing.

Part 1: What is an Emergency Fund?

At its simplest level, an emergency fund is a stash of money set aside for one specific purpose: to cover unexpected financial shocks.

It is not a “new iPhone” fund. It is not a “vacation to Bali” fund. It is not money you dip into because you went over budget on Christmas gifts.

It is money that sits there, boring and untouched, waiting for a crisis. It is your personal insurance policy against life’s unpredictability.

The Psychological Benefit: The “Sleep Well at Night” Factor

Before we get into the math, we need to talk about the psychology. The primary return on investment (ROI) of an emergency fund isn’t interest—it’s Peace of Mind.

Financial stress is one of the leading causes of anxiety, divorce, and health issues. When you have $0 in the bank and your car makes a weird noise, your pulse races. You immediately worry about how you’ll get to work, how you’ll pay the mechanic, and what bill you’ll have to skip to cover it.

When you have a fully funded emergency fund, that same car noise is just an annoyance. It’s an inconvenience, not a catastrophe. You simply transfer the money, fix the car, and move on with your life.

This shift in mindset—from “fragile” to “secure”—changes how you make decisions. You stop making desperate short-term choices (like taking a high-interest payday loan) and start making calm, long-term decisions.

Part 2: The Three Major Risks (Why You Need It)

Many people think, “I have a steady job and a credit card. I don’t need cash sitting around doing nothing.”

This is a dangerous trap. Credit cards are not emergency funds; they are debt traps waiting to spring. Here are the three scenarios where cash is king.

1. The Income Shock (Job Loss)

The economy moves in cycles. Recessions happen. Companies restructure. Even if you are a top performer, you are not immune to layoffs.

If you lose your job tomorrow, how long can you survive without a paycheck? The average job search can take 3 to 6 months.

- Without a fund: You may be forced to take the first job offer you get, even if it pays less or is a bad fit, just to survive.

- With a fund: You have the runway to wait for the right job that advances your career. You can negotiate your salary from a position of strength, not desperation.

2. The Medical Emergency

Even with good health insurance, the costs of a medical crisis can be staggering. Deductibles, co-pays, and out-of-network costs can easily run into the thousands.

A 2023 study found that over 60% of bankruptcies in the United States were related to medical issues. An emergency fund ensures that a broken leg doesn’t result in a broken bank account.

3. The Unforeseen Maintenance

Cars break. Water heaters explode. Roofs leak. These are not “if” events; they are “when” events.

If you own a home or a car, you are signing up for future repair bills. If you don’t have the cash to fix your car, you can’t get to work to earn the money to fix the car. It is a vicious cycle that an emergency fund breaks immediately.

Part 3: How Much Do You Need? (The Math)

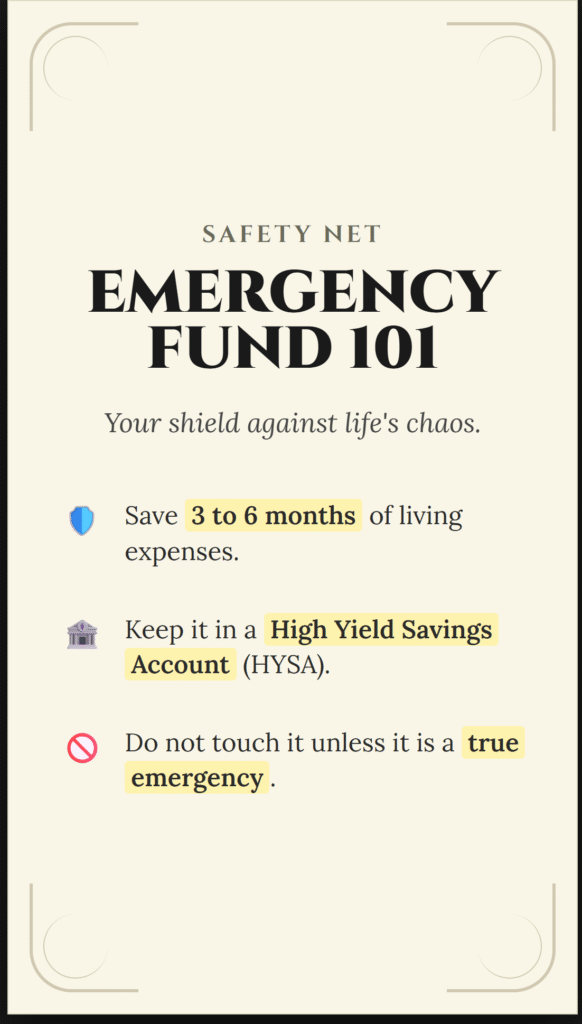

The standard advice from financial experts is simple: Save 3 to 6 months of living expenses.

But which is it? 3 or 6? And what counts as “expenses”?

Step 1: Calculate Your “Survival Number”

Do not base this on your income. Base it on your essential expenses. If the world fell apart, what do you absolutely need to pay to keep a roof over your head and food on the table?

Include:

- Rent/Mortgage

- Utilities (Electricity, Water, Heat, Internet)

- Groceries (Basic needs, not dining out)

- Insurance premiums (Health, Car, Life)

- Minimum debt payments (Student loans, Credit cards)

- Gas/Transportation to get to interviews/work

Exclude:

- Netflix/Spotify subscriptions

- Dining out/Bar tabs

- Clothing budgets

- Vacation savings

- Investments

Example Calculation: Let’s say your total essential monthly survival cost is $3,000.

- 3 Months = $9,000

- 6 Months = $18,000

Step 2: Determine Your Risk Profile (3 Months vs. 6 Months)

Not everyone needs the same size safety net. Where you fall on the spectrum depends on the stability of your life.

Aim for 3 Months if:

- You are single and renting (low liability).

- You have a very stable job (e.g., government employee, tenured teacher).

- You are a dual-income household (if one loses a job, the other still earns).

- You have no dependents (kids).

Aim for 6 Months (or more) if:

- You are the sole breadwinner for a family.

- You have children or dependents.

- You own a home (unexpected repairs are your responsibility).

- You work in a volatile industry (sales, tech startups, seasonal work).

- You have a chronic health condition.

Note: Self-employed freelancers often aim for 9 to 12 months because their income can fluctuate wildly.

Part 4: Where to Keep It (The HYSA Strategy)

This is the most critical tactical advice in this article.

Do not leave your emergency fund in your regular checking account. Why? Two reasons:

- Temptation: If the money is sitting next to your grocery money, you will accidentally spend it. “Oh, I’ll just use a little bit for this concert tickets and pay it back later.” You won’t.

- Inflation: Checking accounts typically pay 0.01% interest. Your money is literally losing value every day due to inflation.

Do not invest your emergency fund in the Stock Market (Crypto/Stocks). Why?

- Volatility: Murphy’s Law states that you will lose your job at the exact same time the stock market crashes. If the market drops 30% and you need to sell your stocks to pay rent, you have locked in a massive loss.

- Liquidity: It takes days to sell stocks and transfer the cash. In an emergency, you often need money now.

The Solution: The High-Yield Savings Account (HYSA)

A High-Yield Savings Account is the only logical place for an emergency fund.

What is it? It is a bank account, usually offered by online banks (like Ally, Marcus, SoFi, or Capital One), that pays a significantly higher interest rate than traditional brick-and-mortar banks (like Chase or Wells Fargo).

Why is it better?

1. The Interest Rates are Massive As of late 2024/2025, traditional banks are still offering around 0.01% to 0.05% APY (Annual Percentage Yield). High-Yield Savings Accounts are offering between 4.00% and 5.00% APY.

Let’s look at the math on a $20,000 Emergency Fund over one year:

| Account Type | Interest Rate | Interest Earned in 1 Year |

| Traditional Big Bank | 0.01% | $2.00 |

| High-Yield Savings (HYSA) | 4.50% | $900.00 |

By simply moving your money to a different bank, you earn an extra $900 of free money per year. It is the easiest passive income you will ever make.

2. FDIC Insurance Just like the big banks, reputable HYSAs are FDIC insured up to $250,000. If the bank goes bust, the government guarantees you get your money back. It is zero risk.

3. Separation Because these accounts are usually at a different bank than your checking account, the money is “out of sight, out of mind.” It takes 1-2 days to transfer the money back to your checking. This slight delay is perfect—it is fast enough for an emergency, but too slow for an impulse buy.

Part 5: How to Build It (Action Plan)

Saving $10,000 or $20,000 sounds daunting. If you stare at the big number, you will never start. Here is how to eat the elephant.

Phase 1: The “Baby” Emergency Fund

Before you worry about the full 6 months, stop everything and save $1,000 to $2,000 as fast as humanly possible.

- Sell clothes you don’t wear.

- Cut subscriptions.

- Eat rice and beans.

- Pick up overtime.

This small buffer will protect you from the minor annoyances (blown tire, broken phone) so you don’t have to use a credit card.

Phase 2: Automate the Rest

Once you have the $1,000 buffer, you can slow down and build the rest steadily.

- The “Pay Yourself First” Method: Set up an automatic transfer on payday. If you get paid on the 1st and 15th, have your bank automatically send $100 (or whatever you can afford) to your HYSA on the 2nd and 16th.

- Treat it like a Bill: You pay your landlord every month. You pay Netflix every month. You must pay your “Future Self” every month.

Phase 3: The Windfalls

Did you get a tax refund? A work bonus? A birthday check from Grandma? The temptation will be to spend this “extra” money. Don’t. Throw 100% of these windfalls into your emergency fund until it is fully funded. This is the fastest shortcut to hitting your goal.

Conclusion: The Foundation of Wealth

It is impossible to build a skyscraper on a swamp. If you try to invest in the stock market or buy real estate without an emergency fund, you are building on a swamp. One bad day will force you to liquidate your investments and ruin your progress.

The Emergency Fund is the concrete foundation. It isn’t sexy. It isn’t exciting. You won’t brag about it at dinner parties.

But it is the fuel for your financial freedom. It gives you the courage to quit a toxic job, the resilience to weather a recession, and the ability to sleep soundly while others are awake worrying about bills.

Your Homework:

- Calculate your monthly survival number.

- Open a High-Yield Savings Account (HYSA) today.

- Set up an automatic transfer for your next payday.

Build your net. Then, walk the wire.