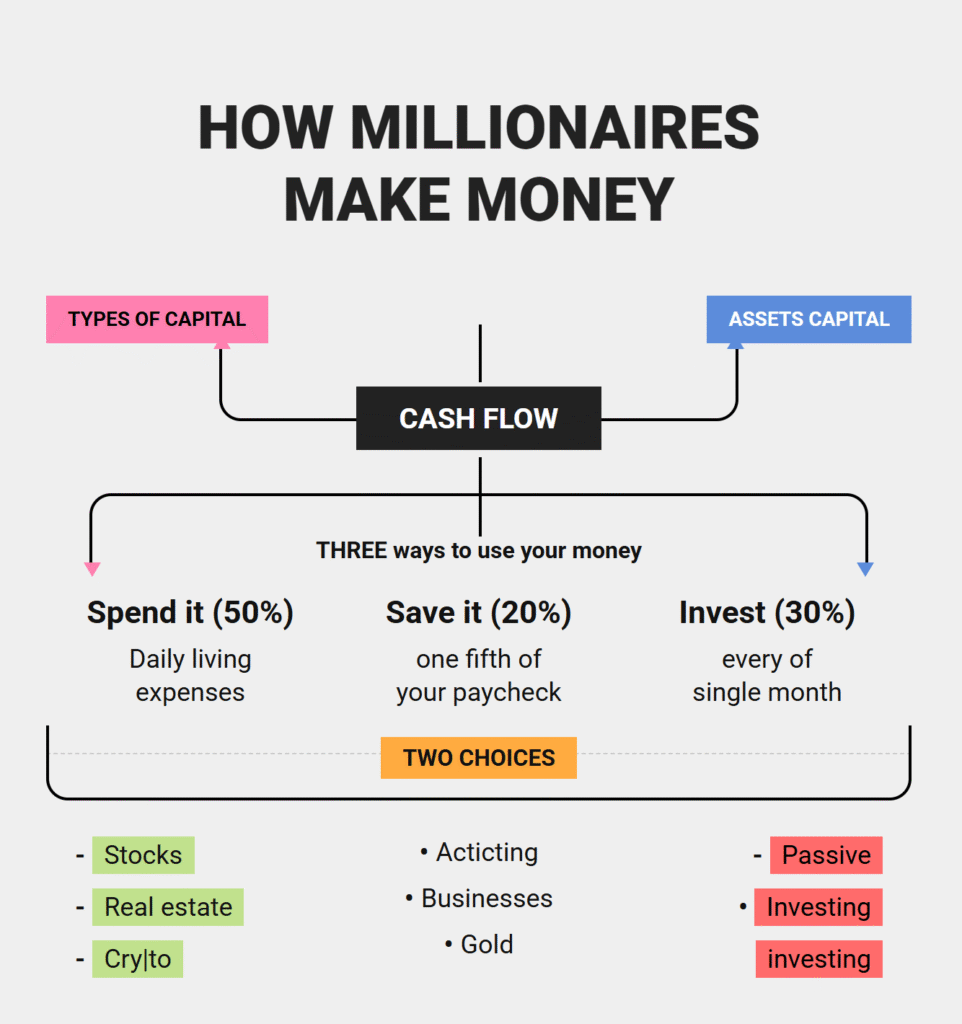

There is a pervasive myth that millionaires are simply people who earn high salaries. While a high income helps, the true secret to wealth isn’t just about how much you make—it is about how you allocate what you make. The infographic provided serves as a simplified roadmap, a visual representation of the financial infrastructure required to move from a paycheck-to-paycheck existence to a life of financial independence.

This guide expands on that visual, breaking down the flow of money, the crucial budgeting ratios, and the specific asset classes that build lasting wealth.

1. Introduction: Decoding the Millionaire Blueprint

The image presents a cyclical system. It is not a linear path where you work, get paid, and die. It is a system where money enters, is filtered through a disciplined budget, and is deployed into assets that generate more money. This is the feedback loop of wealth.

Most people stop at the “Daily Living Expenses” stage. They earn money and spend it. The millionaire mindset, however, treats income not as money to be spent, but as “capital” to be deployed. The ultimate goal illustrated here is Cash Flow—a consistent stream of income that arrives whether you are working or sleeping.

2. The Core Concept: Understanding Cash Flow vs. Stagnant Money

At the center of the infographic is the phrase CASH FLOW. This is the heartbeat of financial freedom.

- Net Worth is a static number (Assets minus Liabilities). You can have a high net worth (e.g., owning a $1 million home) but have zero cash to buy groceries.

- Cash Flow is kinetic. It is the movement of money.

The goal of the system in the image is to take active cash flow (your salary) and convert it into passive cash flow (investments). When your passive cash flow exceeds your 50% daily living expenses, you are technically retired, regardless of your age.

3. Types of Capital: Human Capital vs. Financial Capital

The top left of the image mentions “Types of Capital.” To understand this, we must look at the two phases of a financial life:

- Human Capital: In the beginning, you are the asset. Your time, skills, and energy are traded for money. This is active income.

- Financial Capital: As you follow the 30% investment rule, you build financial capital. Eventually, your money does the heavy lifting so your “Human Capital” doesn’t have to.

The transition from relying on Human Capital to relying on Financial Capital is the definition of becoming a millionaire.

4. The 50/30/20 Rule Reimagined for Aggressive Wealth Building

The infographic presents a modified version of the classic budget rule. The traditional “Senator Elizabeth Warren” rule is 50% Needs, 30% Wants, and 20% Savings.

However, the “Millionaire” version in the image is much more aggressive:

- 50% Living Expenses (Needs)

- 20% Savings (Security)

- 30% Investing (Growth)

Notice that “Wants” (vacations, luxury cars, dining out) are not explicitly listed. In this aggressive model, “Wants” must be squeezed into the 50% living expenses or delayed until the investment income can pay for them.

5. The 50% Base: Mastering Your Daily Living Expenses

“Spend it (50%) – Daily living expenses”

This is the hardest hurdle for most people. Housing, food, transportation, utilities, and insurance usually eat up 70-80% of an average person’s income. To fit this into 50% requires intentional lifestyle design.

Strategies to hit 50%:

- Housing Hacking: Living in a smaller space, or buying a duplex, living in one side, and renting out the other to offset the mortgage.

- Geographic Arbitrage: Earning a salary from a high-cost-of-living area (or remote work) while living in a lower-cost area.

- The Used Economy: Buying cars, furniture, and electronics used to avoid the initial depreciation hit.

If your fixed costs exceed 50%, you have no “fuel” left for the wealth-building engine.

6. The 20% Safety Net: Why Saving is the Precursor to Investing

“Save it (20%) – one fifth of your paycheck”

The image distinguishes between saving and investing. This is a critical distinction. Saving is for security; investing is for growth. You should not invest money you might need in the next 12 months.

Your 20% allocation goes toward:

- Emergency Fund: 3 to 6 months of expenses in a high-yield savings account.

- Sinking Funds: Money set aside for known upcoming expenses (car repair, holidays, insurance premiums).

This capital is “defensive.” It protects you from having to sell your investments (the 30% bucket) during a market downturn just to pay for a broken boiler.

7. The 30% Accelerator: The “Millionaire” Investment Ratio

“Invest (30%) – every single month”

This is the magic number. Most financial advisors recommend saving 10-15% for retirement. That works if you want to retire at 65 with a modest lifestyle. If you want to become a millionaire or retire early, 30% is the target.

Mathematically, if you save and invest 30% of your income, you are working for yourself for roughly one-third of the year. This aggressive capital injection accelerates the compounding effect, reducing the time to financial freedom by decades compared to the standard 10% saver.

8. Asset Capital: How Money Works for You

The right side of the image is labeled “ASSETS CAPITAL.” Once money moves into this bucket, it changes nature. It stops being a medium of exchange and becomes an employee.

An asset is simply something that puts money in your pocket. If you own a house but it costs you money every month without generating income, it is a liability (in terms of cash flow), even if it has value. The infographic lists five specific vehicles for this capital.

9. The Stock Market: Owning a Piece of the Global Economy

Listed in image: “Stocks”

Stocks represent equity ownership in a business. Historically, the stock market has returned an average of about 7-10% per year (inflation-adjusted).

Why Millionaires choose Stocks:

- Liquidity: You can buy and sell instantly.

- Low Barrier to Entry: You can start with $5.

- Passive Nature: You do not need to manage the company; you just hold the shares.

For the average investor, this usually means Index Funds or ETFs (Exchange Traded Funds) that track the S&P 500, rather than picking individual winning stocks.

10. Real Estate: The Bedrock of Generational Wealth

Listed in image: “Real estate”

Real estate provides a “quadruple threat” for wealth building:

- Cash Flow: Tenants pay rent that covers the mortgage and provides monthly income.

- Appreciation: The property value generally goes up over time.

- Loan Paydown: The tenant pays off your debt.

- Tax Benefits: Depreciation and deductions lower your tax bill.

Unlike stocks, real estate is leveraged. You can control a $500,000 asset with only $100,000 (20%) down. This magnifies returns.

11. Cryptocurrency: The High-Risk, High-Reward Frontier

Listed in image: “Cry|to”

The inclusion of Crypto in this infographic acknowledges the modern financial landscape. While controversial, digital assets like Bitcoin and Ethereum have created a new class of millionaires.

- The Upside: Massive potential for appreciation (10x, 100x).

- The Downside: Extreme volatility. It is possible to lose 80% of value in a ‘crypto winter.’

- The Role: For a balanced portfolio, this usually represents a small percentage (1-5%)—a speculative bet that could pay off largely, but won’t ruin you if it fails.

12. Business Ownership: The Ultimate Active Asset

Listed in image: “Businesses”

The middle column mentions “Businesses.” While stocks are passive ownership, starting a business is active ownership.

Almost all “ultra-high-net-worth” individuals (billionaires) made their money here.

- Scalability: A salary is capped by hours worked. A business income is uncapped.

- Tax Advantages: Business owners pay taxes on what is left after spending, whereas employees pay taxes before spending.

- Exit Strategy: You can eventually sell the business for a large lump sum (Exit Capital).

13. Gold and Commodities: The Hedge Against Volatility

Listed in image: “Gold”

Gold is not typically an “investment” that produces cash flow (it pays no dividends). It is a “store of value.”

- Inflation Hedge: When the government prints too much money and the currency loses value, gold typically retains its purchasing power.

- Portfolio Insurance: When stocks crash, gold often remains stable or rises.

- Allocation: Usually 5-10% of a portfolio, used to preserve wealth rather than create it.

14. Active vs. Passive Investing: Defining Your Strategy

The bottom right of the image mentions “Passive Investing.” It is vital to choose your lane.

- Active Investing: requires your time. (e.g., Flipping houses, Day trading stocks, Running a drop-shipping store). Returns can be higher, but it is a second job.

- Passive Investing: requires your patience. (e.g., Buying an Index Fund and holding for 20 years, Buying a REIT). Returns are market-average, but you get your life back.

The “Millionaire Blueprint” usually suggests using Active income (your job/business) to fund Passive investments.

15. The Psychology of Wealth: Delayed Gratification

The 50/30/20 rule looks good on paper, but fails in practice without psychological discipline. The world is designed to make you spend 100% (or 110% via credit cards) of your income.

To invest 30%, you must be willing to look “poorer” than you are. You might drive an older car while your broke neighbor drives a new lease. This is the concept of “Stealth Wealth.” You are buying freedom, not status symbols.

16. Risk Management: Diversification is Key

The image lists multiple asset classes for a reason. Putting 100% of your money into Crypto is gambling. Putting 100% into a Savings account is losing money to inflation.

Diversification is the only “free lunch” in investing.

- If stocks crash, you have Real Estate.

- If the dollar weakens, you have Gold.

- If the economy halts, you have Cash reserves.

A proper millionaire portfolio holds a mix of these distinct assets to smooth out the ride.

17. Compounding: The Mathematical Miracle of Time

Why is the “30% every single month” emphasized? Because of Compound Interest.

If you invest $1,000 a month at an 8% return:

- 10 Years: $182,946

- 20 Years: $592,947

- 30 Years: $1,500,300

The first 10 years feel slow. The last 10 years are explosive. The graph of wealth is not a straight line; it is a hockey stick. The system in the image requires consistency to reach that tipping point.

18. Tax Efficiency: Keeping More of What You Earn

While not explicitly drawn, the distinction between “Capital” and “Spending” implies tax strategy.

- Capital Gains Tax (tax on investment profit) is usually lower than Income Tax (tax on salary).

- Millionaires structure their lives to earn “Capital Gains” rather than “Wages.”

- Utilizing tax-advantaged accounts (like 401ks or IRAs in the US, or ISAs in the UK) accelerates the 30% bucket because that money grows tax-free or tax-deferred.

19. Scaling Up: How to Move from Saver to Investor

If you are currently living on 90% of your income, you cannot jump to the 50/30/20 rule tomorrow. It is a goal, not a starting line.

The Transition Plan:

- Audit: Track every penny for 30 days.

- Cut: Eliminate the “dumb” spending (unused subscriptions, high-interest debt).

- Incremental Increases: Increase your investment rate by 1% every month. You won’t feel the difference in your lifestyle, but in 2 years, you will be investing 24% of your income.

- Bank Raises: Every time you get a raise or bonus, send 100% of the new money to the Investment bucket. Do not inflate your lifestyle.

20. Conclusion: Executing Your Personal Financial Roadmap

The infographic “How Millionaires Make Money” is not really about making money—it is about managing resources. It simplifies complex financial engineering into a three-step process:

- Discipline: Live on half of what you earn.

- Security: Save 20% to protect against the unknown.

- Growth: Invest 30% into diverse assets (Stocks, Real Estate, Business, Crypto, Gold).

Wealth is rarely an accident. It is the result of a deliberate system. By treating your personal finances like a business—focusing on cash flow, managing expenses, and acquiring productive assets—you move from the passenger seat of your financial life into the driver’s seat.