Imagine you are the captain of a massive ship crossing the Atlantic Ocean.

If you build the ship entirely out of lightweight speedboats, you will move incredibly fast when the water is calm. But the moment a storm hits, you will capsize and sink. If you build the ship entirely out of heavy steel bunkers, you will be unsinkable, but you will move so slowly that you’ll never reach your destination before your supplies run out.

To survive the journey and arrive on time, you need a ship that balances speed with stability.

This is exactly what Asset Allocation is.

In the previous articles, we talked about specific tools (Index Funds, Compound Interest). Now, we need to talk about the Blueprint. How do you combine these tools to build a portfolio that can survive a stock market crash, fight inflation, and still grow enough to make you rich?

It comes down to mixing three primary ingredients: US Stocks, International Stocks, and Bonds.

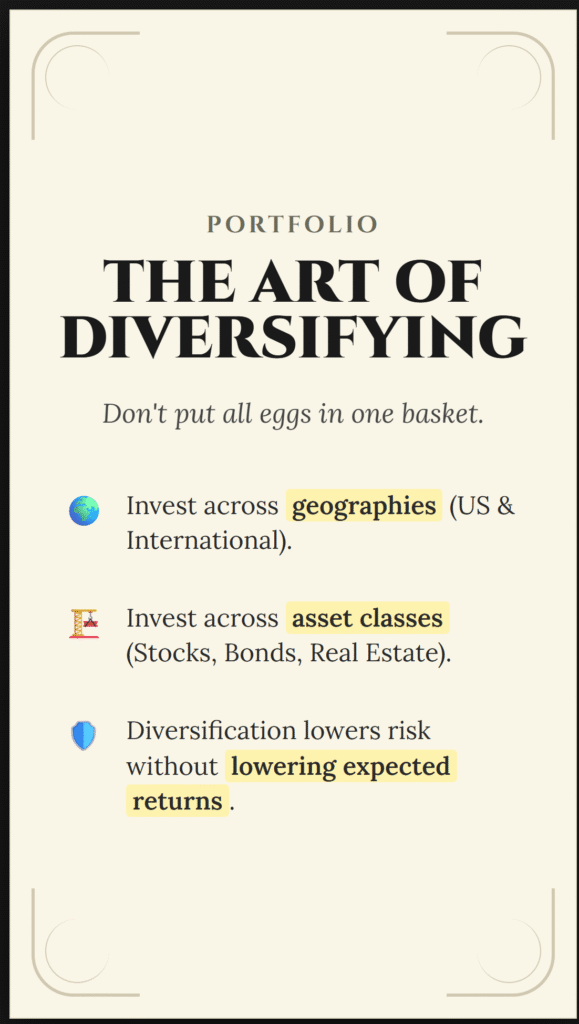

This guide will take you beyond the basic “don’t put all your eggs in one basket” advice. We will explore the mathematics of correlation, the psychology of risk, and the specific formulas used by the world’s best pension funds to protect their wealth.

Part 1: What is Asset Allocation?

Asset Allocation is the strategy of dividing your investment portfolio across different asset categories (classes) to balance risk and reward.

Most people think “Picking Stocks” is the key to high returns. However, a landmark study by Brinson, Hood, and Beebower found that 91.5% of a portfolio’s return is determined not by which stocks you pick, but by your Asset Allocation.

Deciding to be “80% Stocks and 20% Bonds” is infinitely more important than deciding whether to buy Apple or Microsoft.

The Chef Analogy

Think of your portfolio like a meal.

- Stocks (Equities): These are the Carbohydrates and Proteins. They provide the energy. They make you grow. But if you eat only sugar and meat, you might crash.

- Bonds (Fixed Income): These are the Vegetables and Fiber. They are boring. Nobody gets excited about broccoli. But they keep the digestive system stable and prevent health crashes.

- Cash: This is Water. Essential for survival, but no nutritional value (no growth).

A good chef knows the ratios matter. A meal that is 100% sugar is fun for 5 minutes and disastrous for 5 hours. A portfolio that is 100% high-risk tech stocks is fun in a bull market and disastrous in a recession.

Part 2: The Three Ingredients (The Asset Classes)

To master the art of mixing, you must understand the unique flavor profile of each ingredient.

1. US Stocks (The Growth Engine)

When you buy US Stocks (usually via an S&P 500 fund or Total Market fund), you are betting on the American economy.

- Role: To provide aggressive long-term growth.

- Behavior: They are volatile. They can drop 50% in a year (like in 2008), but historically they have returned about 10% annually over long periods.

- The Risk: Concentration risk. If the US economy falters, your entire net worth falters.

2. International Stocks (The Global Hedge)

These are stocks from companies outside the US—developed markets like Japan, UK, and Germany, and emerging markets like China, India, and Brazil.

- Role: To capture growth in the other 96% of the world’s population.

- Behavior: Sometimes they move with US stocks, but often they move differently. There are decades where International stocks beat US stocks (more on this later).

- The Risk: Currency fluctuation and geopolitical instability.

3. Bonds (The Shock Absorber)

A bond is a loan. You lend money to a government or a corporation, and they pay you interest.

- Role: To provide stability and steady income.

- Behavior: Bonds are generally much less volatile than stocks. Crucially, high-quality bonds (like US Treasuries) often go UP when stocks go DOWN.

- The Risk: Inflation. Since bonds pay a fixed interest rate, high inflation can eat away at your real returns.

Part 3: The Magic of Correlation (Why Diversification Works)

This is the technical heart of asset allocation. The goal is not just to own “many things.” The goal is to own things that are Uncorrelated.

Correlation measures how two assets move in relation to each other.

- Correlation of +1: They move in perfect lockstep. (If Asset A goes up 10%, Asset B goes up 10%).

- Correlation of -1: They move in perfect opposites. (If Asset A goes up 10%, Asset B goes down 10%).

- Correlation of 0: They ignore each other completely.

The “Umbrella and Sunscreen” Theory

Imagine you own a stand on the beach.

- Scenario A: You only sell Sunscreen.

- Sunny Year: You make $100,000.

- Rainy Year: You make $0.

- Result: Your income is wildly volatile. You might go bankrupt in a rainy year.

- Scenario B: You only sell Umbrellas.

- Sunny Year: You make $0.

- Rainy Year: You make $100,000.

- Result: Still volatile.

- Scenario C (Asset Allocation): You sell 50% Sunscreen and 50% Umbrellas.

- Sunny Year: Sunscreen sells $50k. Umbrellas sell $0. Total: $50k.

- Rainy Year: Sunscreen sells $0. Umbrellas sell $50k. Total: $50k.

- Result: You make a steady $50k every single year. You have eliminated the risk of bankruptcy.

This is what Bonds do for Stocks. When the economy is booming (Sun), Stocks soar. When the economy crashes (Rain), investors panic and flee to safety. They sell stocks and buy Bonds (specifically US Treasuries). This drives bond prices up.

By holding both, your portfolio becomes an “All-Weather” machine.

Part 4: The Case for International (Escaping “Home Bias”)

One of the most common mistakes American investors make is Home Country Bias. We live in the US, we work in the US, we buy goods in the US, so we assume the US stock market is the only one that matters.

“Why do I need International stocks?” you might ask. “Google and Amazon do business globally anyway!”

While true, history shows that winners rotate.

The Lost Decade (2000–2009)

We mentioned this in the DCA article, but it bears repeating. From 2000 to 2009, the S&P 500 (US Stocks) had a cumulative return of roughly -9%. It was a “lost decade” for American investors. However, during that same decade, Emerging Markets (International stocks) boomed, returning over 100%.

If you were 100% US, you made no money for 10 years. If you had a global portfolio, your International winners offset your US losers, and you made money.

The Japanese Warning (1989)

In 1989, Japan had the strongest economy in the world. The Tokyo stock market was unstoppable. Japanese investors put 100% of their money into Japanese stocks, thinking “Japan is the future.” Then, the bubble burst. The Nikkei index crashed, and it took over 30 years to recover to its 1989 highs.

Imagine waiting 30 years just to break even. This is the danger of betting on a single country. By allocating 20% to 40% of your stock portfolio to International funds (like VXUS), you insure yourself against the possibility that the US might stumble.

Part 5: Bonds: The Boring Hero

In a bull market (when stocks are going up), everyone hates bonds. “Why would I accept a 4% or 5% return from bonds when stocks are doing 20%?”

It feels like owning a fire extinguisher. It’s heavy, it’s annoying, and it costs money. But when the kitchen catches fire, it’s the most valuable thing you own.

The Psychology of the Crash

Let’s say you have $100,000 invested. You are “Aggressive.” You go 100% Stocks. The market crashes 50% (like in 2008). Your portfolio is now $50,000.

Most people think they can handle this. In reality, they panic. They lose sleep. They scream at their spouse. And usually, they sell at the bottom to “save what’s left.” Selling at the bottom destroys your wealth permanently.

Now, imagine you had a 60/40 Portfolio (60% Stocks, 40% Bonds). Stocks drop 50%. Bonds rise 10% (flight to safety).

- Your $60k in stocks becomes $30k.

- Your $40k in bonds becomes $44k.

- Total Portfolio: $74,000.

You are down 26% instead of 50%. This is painful, but it is survivable. Because you didn’t lose half your money, you are less likely to panic sell. You stay in the market, and when the recovery happens, you are there to catch it.

Bonds don’t just reduce risk; they protect you from your own emotions.

Part 6: Standard Models (The Recipes)

So, what is the right mix for you? There is no single answer, but there are standard “recipes” based on your risk tolerance.

1. The Aggressive Growth Portfolio (90/10 or 100/0)

- The Mix: 90% Stocks (Split between US and International) / 10% Bonds.

- Who is it for? People in their 20s and early 30s. You have decades to recover from crashes. You want maximum growth.

- The Vibe: A Ferrari. Fast, but dangerous in the rain.

2. The Balanced Portfolio (60/40)

- The Mix: 60% Stocks / 40% Bonds.

- Who is it for? This is the classic pension fund model. It is for people in their 40s or 50s, or risk-averse investors.

- The Vibe: A Toyota Camry. Reliable. It won’t set speed records, but it will get you there safely.

3. The Conservative Portfolio (30/70)

- The Mix: 30% Stocks / 70% Bonds/Cash.

- Who is it for? Retirees who are living off their portfolio. You cannot afford a 50% drop because you need to withdraw money to buy groceries next month.

- The Vibe: An Armored Truck. Slow, heavy, very safe.

Part 7: Rebalancing (The Secret Sauce)

Here is where asset allocation becomes magic. It forces you to “Buy Low and Sell High” without thinking about it.

This process is called Rebalancing.

The Scenario: You start with a 50/50 portfolio.

- $50,000 Stocks

- $50,000 Bonds

Over the next year, the Stock Market explodes upwards. Bonds stay flat.

- Stocks grow to $70,000.

- Bonds stay at $50,000.

- Total: $120,000.

Your current allocation is now roughly 58% Stocks / 42% Bonds. You are drifting. You are taking on more risk than you intended.

The Rebalance: To get back to 50/50, you must sell $10,000 of Stocks and buy $10,000 of Bonds.

- You are selling stocks after they went up (Selling High).

- You are buying bonds while they are stable/low (Buying Low).

The Crash Scenario: If stocks crashed and your split became 40/60, you would sell bonds (Selling High) and buy stocks (Buying Low).

Rebalancing is a mechanical process that forces you to be a contrarian. When everyone is euphoric about stocks, you are selling a little. When everyone is terrified of stocks, you are buying a little. This discipline adds significant returns over a lifetime.

Part 8: The “Glide Path” (Allocation by Age)

How do you choose your numbers? The most common rule of thumb is based on your age.

The Old Rule: “100 Minus Age”

Subtract your age from 100. That is the percentage of stocks you should own.

- Age 30: Own 70% Stocks.

- Age 60: Own 40% Stocks.

- Critique: With people living longer, many experts think this is too conservative. Bonds don’t pay enough to support a 30-year retirement if you have too many of them.

The New Rule: “120 Minus Age”

- Age 30: 120−30=90% Stocks.

- Age 60: 120−60=60% Stocks.

This keeps you more aggressive for longer, helping you fight inflation over a long retirement.

Target Date Funds (The “Easy Button”)

If all of this math (US vs. International, Stocks vs. Bonds, Rebalancing, Glide Paths) sounds exhausting, there is a solution: Target Date Funds.

Vanguard, Fidelity, and Schwab offer funds that do all of this for you. You just pick the year you plan to retire (e.g., “Target Retirement 2055 Fund”).

- In 2025, the fund is aggressive (90% stocks).

- In 2040, the fund automatically sells stocks and buys bonds to become safer.

- In 2055, the fund is conservative.

You buy one fund. The fund manager handles the asset allocation, the diversification, and the rebalancing. For 90% of investors, this is the optimal choice.

Part 9: Asset Location (Advanced Strategy)

Note: This is for when you have significant wealth, but it’s worth knowing.

Asset Allocation is what you buy. Asset Location is where you put it. Because of taxes, different assets belong in different accounts.

- Bonds: They pay regular interest which is taxed as “ordinary income” (high tax rate).

- Where to put them: Tax-Advantaged Accounts (401k, Traditional IRA). This shelters the interest from taxes.

- Stocks: They grow via appreciation and pay dividends (often lower tax rate).

- Where to put them: Taxable Brokerage Accounts or Roth IRAs (where huge growth is tax-free).

Conclusion: The Only Free Lunch

In finance, there is a saying: “Diversification is the only free lunch.”

Usually, to lower risk, you must accept lower returns. (e.g., Cash is safe but returns 0%). However, by combining assets that are uncorrelated (like US Stocks, International Stocks, and Bonds), you can mathematically lower your risk without proportionally lowering your returns.

You are building a portfolio that can survive anything.

- High Inflation? Your Stocks help you keep up.

- Deflation/Recession? Your Bonds keep you safe.

- US Stagnation? Your International stocks carry the load.

Stop trying to pick the winning horse. Buy the whole track.

Your Action Plan:

- Log into your investment account.

- Check your current breakdown. What % is US Stock? What % is Bond?

- Compare it to your target age-based allocation (e.g., 120 minus Age).

- If you are far off, execute a Rebalance.

Build your ship. Brave the ocean. Reach the destination.