There is a massive difference between looking rich and being rich.

You can drive a brand-new luxury car, live in a massive house, and wear designer clothes, yet still be one paycheck away from bankruptcy. Conversely, you can drive a modest used car and be a millionaire.

The difference comes down to one simple equation: Assets vs. Liabilities.

Understanding this distinction—and specifically how “Cash Flow” works—is the fundamental building block of wealth creation.

Shutterstock

Explore

The Simple Definition

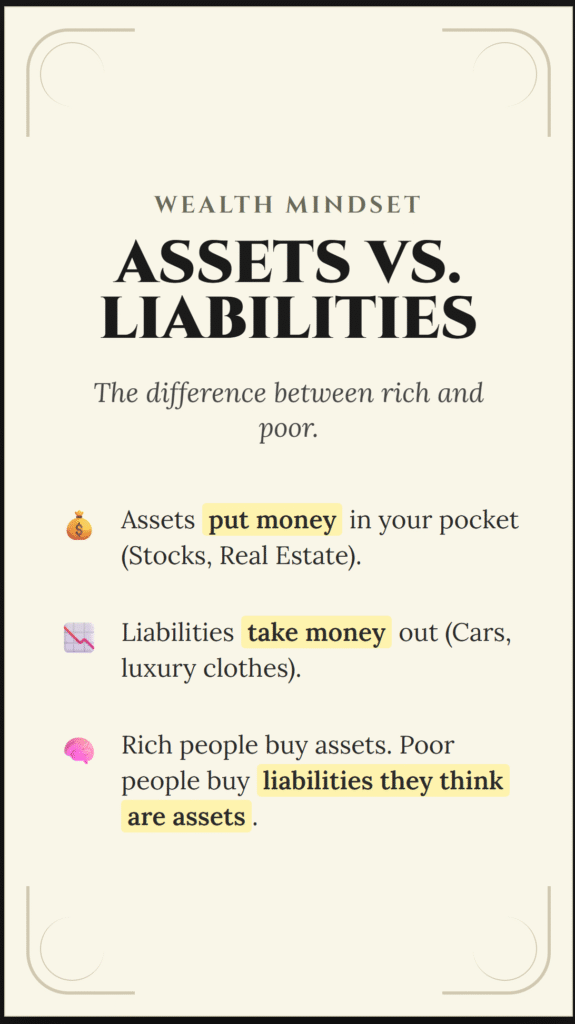

In traditional accounting, an asset is just something you own, and a liability is something you owe. But for building wealth, we need a stricter, more practical definition (popularized by financial experts like Robert Kiyosaki):

- An Asset puts money IN your pocket.

- A Liability takes money OUT OF your pocket.

If you own a house, but it costs you money every month in mortgage payments, taxes, and repairs without generating income, it is acting as a liability. If you own a rental property that pays you rent every month after expenses, it is an asset.

How Assets Make Money: Cash Flow vs. Capital Gains

Not all assets behave the same way. When you buy an asset, you generally aim to make money in one of two ways.

1. Capital Gains

This is the “Buy Low, Sell High” strategy. You buy something (a stock, a house, a piece of gold) hoping that in the future, someone else will pay more for it than you did.

- The Pro: You can make large lump sums of money at once.

- The Con: It is speculative. You only make money when you sell, and if the market crashes, you lose.

2. Cash Flow

This is the “Buy and Hold” strategy. You buy an asset that pays you regularly just for owning it.

- Examples: Rental income from real estate, dividends from stocks, or royalties from a book.

- The Pro: You get paid consistently without selling the asset. This is the key to financial freedom—when your monthly cash flow exceeds your monthly expenses, you can retire.

The Luxury Car Trap: Why It Keeps People Poor

The most common mistake people make when they start earning money is “lifestyle creep”—specifically, buying luxury vehicles.

Society tells us a BMW or a Porsche is a symbol of wealth. The math tells us it is a wealth destroyer.

Here is why a luxury car is a Liability, not an Asset:

- Depreciation: A new car loses roughly 20-30% of its value the moment you drive it off the lot. It is an “asset” that is guaranteed to go down in price, not up.

- The “Feed Me” Cost: Unlike a stock that sits there and grows, a car requires constant feeding. High-octane fuel, expensive synthetic oil changes, premium insurance premiums, and specialized repairs take money out of your pocket every single month.

If you take $50,000 and buy a luxury car, that money is effectively gone and starts shrinking. If you take that same $50,000 and invest it in an asset yielding 7%, you are building a machine that prints money for you.

The Wealthy Mindset

Rich people buy luxuries last; poor people buy luxuries first.

The goal isn’t to never own a nice car. The goal is to buy Assets first (like rental properties or dividend stocks), and eventually use the Cash Flow from those assets to pay for the Liabilities (the luxury car).

- Poor Mindset: Earn Salary → Buy Luxury Car.

- Rich Mindset: Earn Salary → Buy Asset → Asset pays for Luxury Car.

Summary

- Assets put money in your pocket (Stocks, Bonds, Real Estate, Business).

- Liabilities take money out (Loans, Credit Card Debt, Consumer Goods).

- Cash Flow (steady income) is generally safer and more sustainable than relying solely on Capital Gains (selling for profit).

- Avoid the Trap: Don’t buy liabilities that look like wealth until your assets can pay for them.