Imagine a burglar who is so skilled, so quiet, and so patient that he can rob you while you are wide awake, staring right at your wallet. He doesn’t take the cash out of your pocket. He doesn’t break into your safe. Instead, he magically changes the nature of the world around you so that the money you do have becomes increasingly useless.

This thief has a name. It is Inflation.

For decades, we have been conditioned to believe that “cash is king” and that the safest place for our money is in a bank vault. We view the stock market as a casino and real estate as a headache. We cling to the idea that if we have $100,000 in the bank today, we will be safe tomorrow.

This belief is not just wrong; it is financially fatal.

While market crashes are loud, scary, and visible, inflation is a silent killer. It is a slow-motion default on the value of your labor. It is the reason why a millionaire in 1950 was set for life, while a millionaire in 2025 still worries about retirement.

In this comprehensive guide, we will strip away the economic jargon to reveal the brutal mechanics of inflation. We will look at the historical evidence of how it destroys purchasing power, explore the psychology behind why we ignore it, and, most importantly, provide the blueprint for the only defense you have: Investing.

Part 1: The Mechanics of the Heist

To defeat the enemy, you must understand how he operates. What exactly is inflation?

Most people define inflation simply as “prices going up.” You go to the grocery store, and milk costs $4.00 instead of $3.00. You go to the gas station, and filling your tank costs $80 instead of $50.

But “prices going up” is just the symptom. The disease is Currency Devaluation.

Inflation is not necessarily goods becoming more expensive; it is your money becoming worth less. It is a decline in the purchasing power of a specific currency. When the supply of money in an economy grows faster than the supply of goods and services, the value of each individual unit of money drops.

The Supply and Demand of Money

Think of money like any other commodity—like corn or copper.

- If you have a village with 100 loaves of bread and $100 in total circulation, each loaf of bread costs $1.

- If the government suddenly prints another $100 and distributes it, the village now has $200 in circulation. But there are still only 100 loaves of bread.

- Inevitably, the baker will realize people have more cash, and the price of bread will rise to $2.

Nothing about the bread changed. It is the same size, taste, and nutritional value. The bread didn’t get more valuable; the money got weaker.

The Three Types of Inflation

Economists generally categorize inflation into three drivers, all of which attack your savings simultaneously:

- Demand-Pull Inflation: This is the classic “too much money chasing too few goods.” When an economy is booming, people have jobs, and confidence is high, they buy more stuff. Manufacturers can’t keep up, so they raise prices.

- Cost-Push Inflation: This happens when the raw materials to make goods get expensive. If the price of oil doubles, it costs more to transport lettuce to the grocery store. The trucking company charges the grocery store more, and the grocery store charges you more.

- Built-In Inflation (The Wage-Price Spiral): This is a psychological loop. Workers see prices going up, so they demand higher wages to survive. Employers pay the higher wages, but to protect their profit margins, they raise the prices of their products. This causes workers to demand even higher wages, and the cycle continues.

The “CPI” Controversy

The government measures inflation using something called the Consumer Price Index (CPI). They take a theoretical “basket of goods” (milk, eggs, gas, rent, clothes) and track the price of that basket year over year.

However, many financial experts argue that the CPI underestimates the real inflation rate felt by regular people.

- Substitution Bias: If steak gets too expensive, the CPI assumes you will switch to hamburger. If hamburger gets too expensive, it assumes you will eat chicken. The CPI might report that “food costs haven’t risen much,” but that’s only because it assumes your standard of living has dropped.

- Asset Inflation: The CPI tracks consumer goods, but it often does a poor job of tracking assets. It might say inflation is 3%, even though housing prices rose 20% and the stock market rose 15%. If you are trying to buy a home, your “personal inflation rate” is vastly higher than the official government number.

Part 2: The Historical Evidence (The Receipts)

It is easy to ignore inflation year-to-year because 3% doesn’t feel like a lot. It’s like watching grass grow; you don’t see it happening in real-time. But when you zoom out over decades, the devastation of purchasing power is terrifying.

Let’s look at the “receipts” from the American economy to see how the Silent Thief has operated over the last 50 to 70 years.

1. The Housing Market: The Vanishing Dream

In the 1950s and 60s, a single income could support a family, buy a house, and a car. Today, that is a mathematical impossibility for most.

- 1950: The median home price in the U.S. was approximately $7,354.

- 2024: The median home price hovers around $420,000.

“But wait,” you might say, “salaries have gone up too!”

Yes, they have, but not at the same speed.

In 1950, the median family income was about $3,300. This means a house cost roughly 2.2 times the annual family salary.

Today, with a median household income of around $75,000, a home costs roughly 5.6 times the annual salary.

Your money is not just worth less; it is working less efficiently. You have to work more than twice as many years today to buy the same four walls and a roof that your grandparents bought.

2. The Automobile

- 1970: You could buy a brand new Ford Mustang for roughly $2,700.

- Today: A base model Ford Mustang starts around $32,000, with performance models easily exceeding $60,000.

If you had saved $3,000 in a shoe box in 1970 intended to buy your dream car, and you opened that box today, you wouldn’t be able to buy the car. You wouldn’t even be able to buy the engine. You might be able to buy the tires.

3. The Big Mac Index

The Economist magazine famously created the “Big Mac Index” as a lighthearted way to measure purchasing power.

- 1986: A Big Mac cost $1.60.

- Today: The average price is over $5.30 (and much higher in cities like NYC or LA).

This illustrates that the “store of value” function of cash is broken. If you hold cash, you are effectively agreeing to donate a percentage of your labor to the void every year.

Shutterstock

Part 3: The Math of Loss (Reverse Compounding)

We often hear about the magic of Compound Interest—how money grows exponentially over time.

Inflation is the evil twin: Reverse Compounding. It shrinks your wealth exponentially over time.

To understand how fast your money dies, we can use a variation of the Rule of 72.

Usually, you divide 72 by your interest rate to see when your money doubles.

For inflation, you divide 72 by the inflation rate to see when your money halves.

The Scenario: The “Safe” Saver

Let’s meet Sarah. Sarah is risk-averse. She is terrified of the stock market. She sold a business and has $100,000 in cash. She decides to keep it in a standard checking account (earning 0%) for her retirement in 20 years.

Let’s assume the historical average inflation rate of 3.5%.

$$72 \div 3.5 = 20.5 \text{ years}$$

This means that in roughly 20 years, Sarah’s money will be cut in half.

When she retires, her bank statement will still say “$100,000.” No money was “stolen.”

However, that $100,000 will only buy $50,000 worth of goods and services.

She has lost half of her life’s work simply by standing still.

The Tax Drag: The Double Whammy

It gets worse. If you try to fight inflation with a low-yield investment (like a CD or a bond) that pays 5%, you have to pay taxes on that growth.

- Inflation: 3%

- Your Bond Yield: 5%

- Your Tax Rate: 20%

You might think you are making 2% profit (5% – 3%).

Wrong.

You make 5% interest. The government takes 20% of that profit (1% total). Your return is now 4%.

Inflation takes 3%.

Your Real Return: 1%.

You are barely treading water. To truly build wealth, you need returns that aggressively outpace both the tax man and the inflation thief.

Part 4: The Psychology of Cash (The Money Illusion)

If the math is so obvious, why do millions of people hoard cash? Why do we feel safe with a savings account and scared of a stock portfolio?

It comes down to a cognitive bias known as The Money Illusion.

Humans are wired to look at Nominal Value (the number on the paper), not Real Value (what the paper buys).

- If your boss gives you a 2% raise, you feel happy. “I’m making more money!”

- But if inflation is 4%, you are actually making less money than you were last year. You essentially took a pay cut.

Because the number on your paycheck went up, your brain registers it as a “win.”

Conversely, the stock market is volatile. You can see the number go down on a Tuesday.

- Stock Market Drop: Visible loss. Panic.

- Inflation Loss: Invisible loss. Indifference.

We are evolutionarily programmed to react to immediate, visible threats (a tiger, a fire, a market crash). We are terrible at reacting to slow, invisible threats (heart disease, climate change, inflation).

To become wealthy, you must retrain your brain to fear the silent erosion of cash more than you fear the volatility of the market.

Part 5: When the Thief Goes Crazy (Hyperinflation)

You might think, “Well, 3% isn’t that bad. I can live with that.”

But inflation is not a constant law of physics like gravity. It is a man-made phenomenon, and it can spiral out of control.

History is littered with empires that collapsed because they debased their currency. This is known as Hyperinflation.

Weimar Republic (Germany, 1920s)

After WWI, Germany printed money to pay war debts. The inflation was so severe that prices doubled every few days.

- A loaf of bread cost 250 marks in January 1923.

- By November 1923, it cost 200,000,000,000 marks.People burned cash in their fireplaces because it was cheaper than buying wood. People carried money in wheelbarrows. If you left your wheelbarrow outside, thieves would steal the wheelbarrow and leave the money.

Zimbabwe (2000s)

In the late 2000s, Zimbabwe experienced inflation rates estimated at 79 billion percent month-over-month. They printed a 100 Trillion Dollar Note. That note, at the height of the crisis, couldn’t even buy a bus ticket.

Venezuela (Present Day)

Once the wealthiest country in South America, Venezuela’s currency collapsed due to mismanagement. Millions of people saw their life savings—decades of hard work—evaporate into nothingness within a few years.

The Lesson: While the US Dollar or the Euro are relatively stable, no fiat currency is immune to gravity. Holding 100% of your wealth in paper currency is a bet that the government will never make a mistake. That is a risky bet.

Part 6: Investing is a Necessity, Not a Luxury

In the past, our grandparents might have relied on a company pension. They worked for 40 years, and the company promised to send them a check every month until they died. The company took the risk of investing that money to beat inflation.

Today, pensions are dead. They have been replaced by 401(k)s and IRAs. The risk has been shifted from the employer to YOU.

This means you are now your own Pension Fund Manager.

If you choose not to invest, you are guaranteed to fail as a fund manager. You cannot save your way to retirement. You cannot work hard enough to outrun a 3% compounding loss of value.

Investing is the only mechanism that allows you to:

- Preserve your purchasing power.

- Grow your wealth significantly above the rate of inflation.

You are not investing to buy a yacht. You are investing so that a gallon of milk doesn’t bankrupt you when you are 85 years old.

Part 7: Your Defense Strategy (Asset Classes)

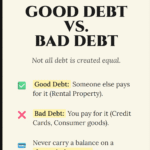

So, if cash is trash, where should you put your money? You need Hard Assets—things that have intrinsic value and tend to rise in price when the dollar falls.

Here are the primary shields against inflation:

1. Equities (The Stock Market)

Owning stock is owning a piece of a business.

Why does this beat inflation?

Because businesses can raise prices.

If inflation hits and the cost of raw materials goes up, Coca-Cola raises the price of a can of Coke. If you own Coca-Cola stock, your investment captures that price increase. Over the last century, the S&P 500 has returned an average of roughly 10%, crushing the 3% inflation rate.

2. Real Estate

Real Estate is often considered the ultimate inflation hedge for two reasons:

- Rising Rents: As inflation rises, landlords increase rent. This creates a higher cash flow.

- Fixed Debt: This is the magic trick. If you have a 30-year fixed mortgage, your payment stays the same forever (e.g., $2,000/month). But inflation makes money worth less. In 20 years, $2,000 will be “pocket change,” but your mortgage payment won’t have changed. You are paying off debt with cheaper and cheaper dollars.

3. Commodities (Gold & Silver)

For thousands of years, gold has been the standard store of value. It creates nothing (no cash flow), but it tends to hold its purchasing power.

- In Roman times, an ounce of gold could buy a nice toga and a pair of sandals.

- Today, an ounce of gold (~2,600 USD) can buy a nice suit and a pair of shoes.It doesn’t make you rich, but it keeps you from getting poor.

4. TIPS (Treasury Inflation-Protected Securities)

For the risk-averse, the US government offers bonds specifically designed to fight the Silent Thief. The principal value of TIPS increases with inflation (as measured by CPI). If inflation goes up 5%, the value of your bond goes up.

5. Bitcoin (The Digital Gold?)

A newer entrant to the conversation is cryptocurrency, specifically Bitcoin. Proponents argue that because Bitcoin has a hard cap (only 21 million will ever exist), it cannot be debased like the dollar. While highly volatile, many view it as a long-term hedge against reckless government money printing.

Part 8: The Action Plan

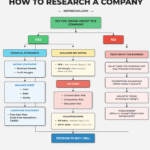

Knowledge without action is useless. How do you structure your life to beat the Silent Thief starting today?

Step 1: Audit Your Cash

Look at your bank accounts.

Do you have more than 6 months of living expenses sitting in a checking account yielding 0.01%?

If the answer is yes, you are bleeding money.

- Action: Keep 1-2 months in Checking. Move 3-6 months to a High-Yield Savings Account (HYSA) (currently paying 4-5%). Invest the rest.

Step 2: Invest Automatically

You cannot time the market, and you cannot predict inflation spikes. The best strategy is Dollar Cost Averaging.

Set up an automatic transfer every payday into a diversified portfolio (like a low-cost S&P 500 Index Fund).

- Action: If you buy consistently, you buy more shares when prices are low and fewer when prices are high. Over decades, this captures the growth of the global economy and outpacing inflation.

Step 3: Shift Your Mindset to “Real Returns”

Stop looking at the price tag. Start looking at the hours of labor.

- Don’t say: “This TV costs $1,000.”

- Say: “This TV costs me 20 hours of work.”

- Don’t ask: “What is the interest rate on this savings account?”

- Ask: “What is the Real Rate of Return after taxes and inflation?”

Step 4: Buy Assets Early

The earlier you buy assets, the more inflation works for you instead of against you.

If you buy a home today, you lock in today’s price. In 30 years, when everyone else is complaining about how expensive houses are, you will be sitting on a massive amount of equity, paying a mortgage based on 2025 prices.

Conclusion

The Rule of 72, the Assets vs. Liabilities equation, the Emergency Fund—these are all tools in your toolkit. But understanding Inflation is the motivation to use them.

It is the reason you cannot afford to be passive.

It is the reason “saving money” is not enough.

The Silent Thief is unrelenting. He does not sleep. He does not take holidays. Every day you leave your capital idle, he takes a sliver of it. The only way to stop him is to move your money into vehicles that are faster, stronger, and more resilient than the currency itself.

You have worked hard for your money. Don’t let it vanish into thin air.

Invest it.