In almost every area of life, “lazy” is an insult. If you are a lazy employee, you get fired. If you are a lazy athlete, you lose. If you are a lazy student, you fail.

But in the upside-down world of the stock market, lazy investors are the champions.

The investors who spend hours every day reading financial news, analyzing charts, and trading stocks almost always lose money in the long run. Meanwhile, the investors who do literally nothing—who buy a single boring fund and then go take a nap for 20 years—end up wealthy.

This isn’t just a theory. It is a mathematical fact backed by decades of data.

This guide will explain the “Index Fund Revolution,” why 90% of professional money managers fail to beat a simple computer algorithm, and how you can use this “lazy” strategy to build a fortune.

Part 1: The Great Wall Street Lie

Wall Street is an industry built on a myth. The myth is that investing is complicated, that stock picking is a skill reserved for the elite, and that you need to pay a professional high fees to manage your money because they “know something you don’t.”

They want you to believe that there are “Super Investors” who can consistently predict which stocks will go up and which will go down.

The Reality: The SPIVA Scorecard

Every year, S&P Dow Jones Indices releases a report called SPIVA (S&P Indices Versus Active). It measures how active fund managers (professionals who pick stocks) perform against the S&P 500 index.

The results are embarrassing for the industry.

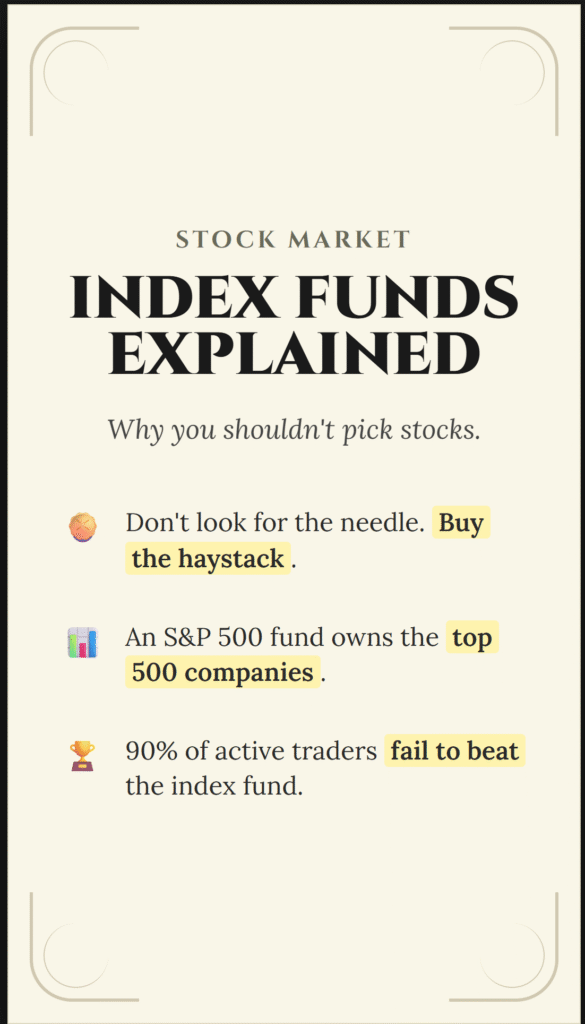

- Over 1 year: Roughly 60-70% of active managers fail to beat the market.

- Over 10 years: Roughly 85% of active managers fail to beat the market.

- Over 20 years: Roughly 94% of active managers fail to beat the market.

Let that sink in. These are people with Ivy League degrees, Bloomberg terminals, and teams of analysts. They charge you massive fees (1% to 2% of your wealth) to manage your money. And over a 20-year period, 94% of them would have done better if they had just fired themselves and bought a simple Index Fund.

Part 2: What is an Index Fund?

To understand why the pros fail, you have to understand what they are fighting against.

An Index Fund is a basket of stocks that automatically tracks a specific market “Index.” It doesn’t try to pick winners. It doesn’t try to time the market. It just buys everything.

The most famous index in the world is the S&P 500.

The S&P 500 Explained

The Standard & Poor’s 500 is a list of the 500 largest publicly traded companies in the United States. It includes Apple, Microsoft, Amazon, Google, Tesla, Walmart, Exxon, and hundreds more.

When you buy an S&P 500 Index Fund (like the famous VOO or SPY ETFs), you are buying a tiny slice of all 500 companies at once.

- If Apple goes up, you make money.

- If Amazon goes down, you lose a little, but it’s balanced out by the other 499 companies.

“Buying the Haystack”

The legendary investor John Bogle, who founded Vanguard and invented the index fund, had a famous analogy:

“Don’t look for the needle in the haystack. Just buy the haystack!”

Stock pickers are frantically searching for the one “needle” (the next Tesla) that will make them rich. Most of them fail and just end up with a handful of dry grass. Index investors simply buy the entire haystack. They own the needles, the grass, the bugs, everything. And because the US economy (the haystack) grows over time, they get rich.

Part 3: Why the Index Always Wins (The Self-Cleansing Mechanism)

You might ask: “If the S&P 500 blindly buys companies, doesn’t it own bad companies too?”

Yes, but it has a secret weapon: Survival of the Fittest.

The S&P 500 is not a static list. It is ruthless.

- To get on the list: A company must be massive, profitable, and highly valuable.

- To stay on the list: It must stay massive and valuable.

If a company starts to fail (think of Blockbuster, Kodak, or Sears), its value drops. As it shrinks, it becomes a smaller and smaller percentage of the index. Eventually, it is kicked out of the S&P 500 entirely. It is then replaced by a new, growing company (like Tesla or Nvidia were in recent years).

The Result: The S&P 500 is a “self-cleansing” machine. It automatically ruthlessly culls the losers and adds the winners without you doing a single thing. You are always invested in the top 500 champions of the economy because the index forces you to be.

Part 4: The Million-Dollar Bet (Buffett vs. The Hedge Funds)

In 2007, Warren Buffett, the greatest investor of all time, grew tired of hearing hedge fund managers brag about their complex strategies and high fees.

So, he issued a public challenge. He bet $1,000,000 that a simple, boring S&P 500 Index Fund would outperform a hand-picked portfolio of elite Hedge Funds over a 10-year period.

A firm called Protégé Partners accepted the bet. They selected five “funds of funds”—the best of the best—managed by geniuses who used advanced algorithms and short-selling strategies.

The Race (2008–2017): The bet started right before the 2008 Financial Crisis—a time when active managers should have had an advantage because they could protect downside, while the Index Fund blindly took the hit.

The Result:

- The Hedge Funds: Returned roughly 36% (after fees) over 10 years.

- The S&P 500 Index Fund: Returned roughly 126% over 10 years.

It wasn’t even close. The “lazy” strategy destroyed the “smart” strategy. Buffett won the bet, donated the winnings to charity, and proved once and for all that for 99% of people, the Index Fund is king.

Part 5: The Math of Fees (The Silent Killer)

Why did the hedge funds lose so badly? Was it because they were stupid? No. It was because of Fees.

In investing, you get what you don’t pay for.

- Active Funds: Charge 1% to 2% per year (Expense Ratio).

- Index Funds: Charge 0.03% per year (e.g., Vanguard VOO).

The Impact of 2%: If you invest $100,000 over 30 years with an 8% annual return:

- At 0.03% Fee (Index): You end up with roughly $1,000,000.

- At 2.00% Fee (Active): You end up with roughly $570,000.

That tiny 2% fee didn’t cost you 2% of your money. It cost you nearly 50% of your final wealth. The active manager stole half your retirement just for the privilege of underperforming the market.

Part 6: How to Be a “Lazy” Investor (The Strategy)

If you are ready to stop gambling and start investing, here is the playbook.

1. The Vehicle

You can buy Index Funds inside almost any account:

- 401(k)

- Roth IRA

- Standard Brokerage Account

2. The Ticker Symbols

You don’t need to overthink this. You need a fund that tracks the S&P 500 or the Total US Stock Market.

- Vanguard S&P 500 ETF (VOO)

- SPDR S&P 500 ETF (SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard Total Stock Market ETF (VTI) (This includes small companies too).

3. The Behavior

This is the hard part. Buying the fund is easy. Holding the fund is hard. When the market crashes (and it will), the news will scream “The S&P 500 is collapsing!” Your instinct will be to sell to “stop the bleeding.” You must do nothing. Remember the self-cleansing mechanism. Remember the history. The market has recovered from every single crash in history—World War II, the Dot-com Bubble, the 2008 Crisis, Covid-19—and gone on to hit new highs.

If you sell, you lock in the loss. If you hold (and keep buying), you ride the recovery.

Conclusion: The Ultimate Freedom

Index investing is not just a financial strategy; it is a lifestyle choice.

It frees you from the stress of checking stock prices. It frees you from the anxiety of “Did I pick the right company?” It frees you from the regret of missing out on the next big thing (because you already own it).

It allows you to focus on what actually matters: your career, your family, and your life.

While your friends are stressing over whether Tesla stock is going up or down tomorrow, you can smile, knowing that you own Tesla, and Apple, and Microsoft, and the rest of the American economy. You are the owner of the casino, not the gambler.

Be lazy. Win big.