If you ask ten people why they don’t budget, nine of them will give you the same answer: It is too complicated.

The word “budget” often conjures up images of strict diets, deprivation, and hours spent agonizing over spreadsheets, tracking every single latte and pack of gum. It feels restrictive. It feels like a punishment for spending money.

But what if budgeting wasn’t about restriction? What if it was simply about allocation?

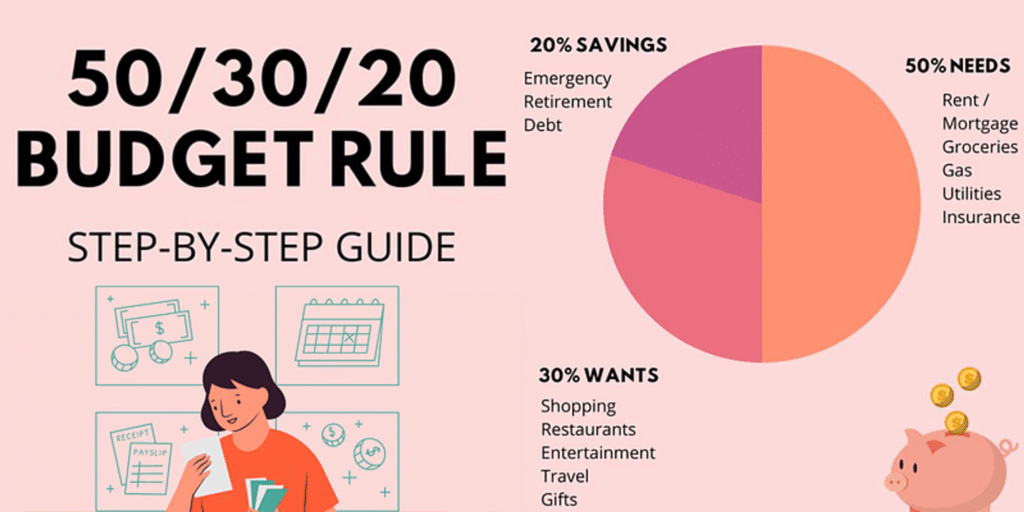

Enter the 50/30/20 Rule.

Popularized by Senator Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan, this rule has become the gold standard for personal finance because of its simplicity. It doesn’t ask you to track every penny. It doesn’t ask you to stop drinking coffee. It simply asks you to sort your money into three buckets.

In this comprehensive guide, we are going to break down exactly how the 50/30/20 rule works, how to customize it for your life, and how to use it to go from “just getting by” to building serious long-term wealth.

Part 1: What is the 50/30/20 Rule?

The 50/30/20 rule is a proportional budgeting method that divides your after-tax income (your net pay) into three distinct categories:

- 50% for Needs: The essentials you cannot live without.

- 30% for Wants: The lifestyle choices that make life enjoyable.

- 20% for Goals: The financial moves that secure your future.

Why percentages matter

The beauty of using percentages rather than fixed dollar amounts is that the rule grows with you. If you are a student making $2,000 a month, the rule applies. If you are an executive making $20,000 a month, the rule still applies. It scales up and down, preventing “lifestyle creep” from devouring your raises before you even see them.

The “Net Income” disclaimer

Before you start the math, it is crucial to understand that this rule applies to your take-home pay. This is the amount that actually hits your bank account after taxes, health insurance premiums, and pre-tax retirement contributions (like a 401k) have been deducted.

If your annual salary is $60,000, your gross monthly income is $5,000. However, after taxes and deductions, your net paycheck might be closer to $3,800. You would base your 50/30/20 calculations on the $3,800 figure.

Part 2: The 50% Bucket – Needs

The first and largest bucket is for your Needs. According to the rule, these should consume no more than half of your take-home pay.

What counts as a “Need”?

A need is an expense that, if unpaid, would result in immediate severe consequences (eviction, loss of job, health issues, or jail).

Common “Needs” include:

- Housing: Rent or mortgage payments, property taxes, and HOA fees.

- Utilities: Electricity, water, gas, and heating.

- Transportation: Car payments, basic insurance, gas, or public transit passes.

- Groceries: Basic food required to live (this does not include dining out or premium delivery services).

- Insurance: Health insurance (if paid out of pocket) and life insurance.

- Minimum Debt Payments: The minimum payment required on credit cards or loans to keep your account current and avoid damaging your credit score.

The “Grey Area” of Needs

In the modern world, the line between need and want is often blurred.

- Is the Internet a need? For most people today, yes. If you need it to do your job or manage your household finances, it is a utility.

- Is a smartphone a need? Having a phone is a safety need. Having the latest iPhone Pro Max with an unlimited data plan is a want.

- Is a car a need? If you live in a city with poor public transit, a reliable vehicle is a need. A luxury SUV with heated seats is a want masked as a need.

What if my Needs are over 50%?

This is the most common hurdle, especially for people living in High Cost of Living (HCOL) areas like New York, London, or San Francisco. If your rent alone takes up 45% of your income, hitting the 50% target for all needs is mathematically impossible.

If you find yourself in this boat, you have two options:

- Radical Cost Cutting: This might mean moving to a cheaper apartment, getting a roommate, selling a car with a high monthly payment, or refinancing loans.

- Income Expansion: If you cannot cut costs further, you must increase the shovel. This implies side hustles, asking for a raise, or job hopping.

Note: If your needs are at 60% or 70%, you must borrow from the “Wants” bucket to cover the difference. You should never borrow from the “Goals” bucket if you can avoid it.

Part 3: The 30% Bucket – Wants

This is the category that makes the 50/30/20 rule sustainable. Most budgets fail because they are too restrictive (the “crash diet” approach). The 30% bucket gives you permission to spend money on yourself without guilt.

What counts as a “Want”?

A want is anything that improves the quality of your life but isn’t strictly necessary for survival.

Common “Wants” include:

- Dining Out & Takeout: Even if it’s food, if it’s prepared by someone else, it’s a want.

- Entertainment: Netflix, Spotify, concert tickets, movies, and video games.

- Travel: Vacations, weekend getaways, and unnecessary Uber rides.

- Shopping: New clothes (beyond basics), electronics, home decor, and hobbies.

- Upgrades: The difference between a basic gym membership and a luxury health club; the difference between generic pasta and imported truffle pasta.

The Psychology of the 30%

Allocating 30% to wants is not irresponsible; it is strategic. When you know you have a designated amount of money to “blow” every month, you stop stress-spending. You can buy the $5 latte guilt-free because you know it fits within your 30%.

However, 30% is a limit, not a target. You don’t have to spend this money. If you are aggressive about Early Retirement (FIRE), you might choose to slash your Wants to 10% and move that extra 20% into your Goals bucket. But for the average person, 30% provides a healthy psychological buffer.

Part 4: The 20% Bucket – Goals

This is the most critical bucket. This 20% is what separates those who live paycheck-to-paycheck from those who build generational wealth. This is the money you pay to your future self.

What counts as a “Goal”?

This category covers three main pillars of financial health:

- Savings:

- Emergency Fund: Building up 3–6 months of expenses.

- Sinking Funds: Saving for known future expenses like a wedding, a new car, or a down payment on a house.

- Investments:

- Retirement: Contributions to IRAs, Roth IRAs, or taxable brokerage accounts. (Note: If you contribute to a 401k directly from your paycheck, that counts toward this 20%, but remember to adjust your “Net Income” calculation to include that money back in so the math works).

- Debt Repayment (Beyond Minimums):

- While minimum payments are a “Need,” any extra payments made to crush the principal balance count as a “Goal.”

The Order of Operations for the 20%

You shouldn’t just throw money into this bucket randomly. You need a hierarchy of needs for your goals:

- Starter Emergency Fund: First, use the 20% to save $1,000 to $2,000 to cover minor disasters.

- Employer Match: If your job offers a 401k match, contribute enough to get it. That is an immediate 100% return on investment.

- High-Interest Debt: Attack credit cards or loans with interest rates above 7-8%.

- Full Emergency Fund: Build that 3-6 month safety net.

- Investing: Max out Roth IRAs and other investment vehicles.

Part 5: How to Implement the Rule (Step-by-Step)

Ready to start? Here is a practical workflow to implement the 50/30/20 rule today.

Step 1: Calculate Your Monthly Take-Home Pay

Check your bank statements. If you are a salaried employee, this is easy: look at the deposit amount. If you are a freelancer, take your average monthly income and subtract 30% for taxes immediately.

Example: You take home $4,000 per month.

Step 2: Calculate Your Thresholds

Multiply your income by the percentages.

- Needs (50%): $4,000 x 0.50 = $2,000

- Wants (30%): $4,000 x 0.30 = $1,200

- Goals (20%): $4,000 x 0.20 = $800

Step 3: Audit Your Last Month

Log into your online banking or credit card portal. Export the last 30 days of transactions. Go through them line by line and label them “Need,” “Want,” or “Goal.”

Be honest with yourself. Was that Amazon purchase a need? Was that fourth trip to the grocery store actually for essentials, or was it for snacks?

Step 4: Adjust and Automate

Compare your actual spending to your Step 2 thresholds.

- Are your Needs too high? Look at your “Big Three” expenses: Housing, Transport, and Food. Can you meal prep? Can you refinance a car?

- Are your Wants too high? Look for “subscription creep” (streaming services you don’t use) or impulsive dining out.

The Golden Ticket: Automation The best way to stick to the 50/30/20 rule is to remove human willpower from the equation.

- Set up an automatic transfer on payday that moves your 20% (Goals) immediately into a separate high-yield savings account or investment account.

- Leave the 50% (Needs) in your checking account for bills.

- Move the 30% (Wants) to a separate checking account or a prepaid card. When that account hits $0, your fun spending stops for the month.

Part 6: Frequently Asked Questions

Q: Does charitable giving count as a Want or a Goal? A: This is personal. Some financial experts categorize charity (like tithing) as a “Need” if it is a non-negotiable part of your value system. Others view it as a “Want” (discretionary spending). Very few classify it as a “Goal” unless it is part of a tax strategy.

Q: I have a lot of debt. Should I change the percentages? A: Yes. The 50/30/20 rule is a template, not a law. If you are drowning in high-interest credit card debt, a 50/10/40 split might be better. Slash your wants to 10% temporarily and throw 40% at your debt until the fires are put out.

Q: What if I have an irregular income? A: If you are a freelancer or commission-based, base your 50/30/20 calculation on your lowest average month. In high-earning months, keep your Needs and Wants dollar amounts the same as the low months, and throw 100% of the surplus income into the Goals bucket.

Q: Where do “Sinking Funds” fit? A: Sinking funds (saving for a vacation, Christmas gifts, or car repairs) can be tricky.

- If saving for a car repair: Need (or Emergency Fund).

- If saving for a vacation: Want (deferred spending).

- If saving for a house down payment: Goal.

Conclusion

The 50/30/20 rule is not about depriving yourself of joy. It is about creating a structure that allows you to enjoy your life today while protecting your life tomorrow.

By explicitly allocating 30% of your income to “Wants,” you remove the guilt associated with spending. By prioritizing 20% for “Goals,” you ensure that you aren’t waking up at age 60 with nothing to show for your years of hard work.

Your assignment for today: Log into your bank account, calculate your average monthly net income, and write down your three numbers. Does your current spending align with the rule? If not, pick one category to adjust this week.