“It is not what you earn that determines your wealth; it is what you keep.”

There is a persistent myth among the general public that the tax code is “broken.” People often look at headlines regarding billionaires paying a lower effective tax rate than their secretaries and assume this is the result of illegal evasion or secret offshore accounts.

In reality, the tax code is working exactly as it was designed. The United States tax code (and that of many other developed nations) is not just a method for collecting revenue; it is a complex system of incentives designed to stimulate economic activity. The government wants housing built, businesses started, and energy produced. Therefore, they offer tax breaks to those who do these things.

The average employee pays taxes on their income before they spend it. The wealthy have perfected a different equation: they spend, invest, and borrow first, paying taxes only on what is left over—if anything at all.

This guide creates a detailed roadmap of the mechanisms used by the top 0.1% to minimize their tax burden, focusing on asset accumulation, debt leverage, and estate planning.

Part I: The Fundamental Mindset Shift

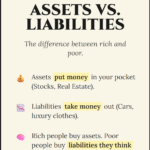

To understand how the rich avoid taxes, one must first understand the three types of income. The tax code treats these three buckets very differently.

1. Earned Income (The Highest Taxed)

This is money traded for time. Salaries, wages, bonuses, and tips fall into this category. In the U.S., this is subject to the highest marginal tax brackets (up to 37% Federal, plus State taxes), along with FICA taxes (Social Security and Medicare).

- The Trap: There are very few deductions available for W-2 employees. You earn the money, the government takes its share immediately, and you live on the remainder.

2. Portfolio Income (The Middle Ground)

This is income from selling assets—capital gains. If you buy a stock for $100 and sell it for $200, the $100 profit is capital gains.

- The Advantage: Long-term capital gains (assets held for more than a year) are taxed at significantly lower rates (0%, 15%, or 20%) than earned income.

3. Passive Income (The Holy Grail)

This is income derived from enterprises in which you are not materially involved, such as rental real estate or limited partnerships.

- The Advantage: This income can often be offset entirely by “phantom expenses” like depreciation, resulting in a tax bill of zero.

Thing to Remember: The wealthy do not try to get a higher salary. They try to convert as much of their financial life as possible from Category 1 (Earned) to Category 3 (Passive) or Asset Growth.

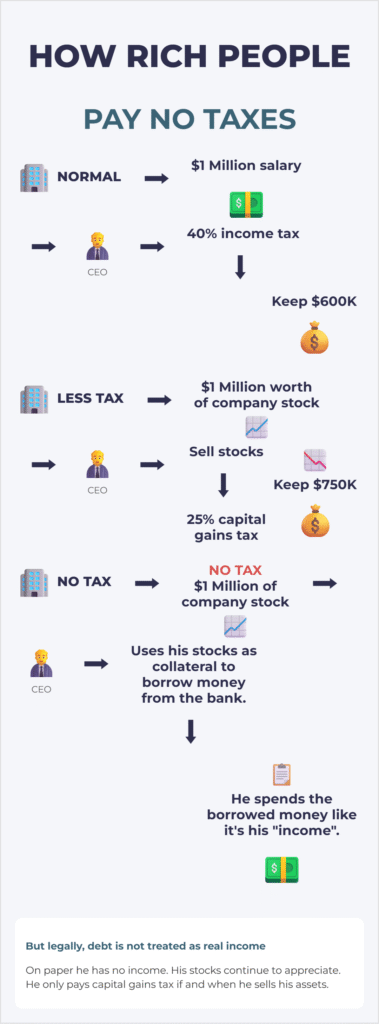

Part II: The “Buy, Borrow, Die” Strategy

Popularized by law professor Edward McCaffery, this is the single most effective strategy used by billionaires to fund their lifestyles without triggering a tax bill.

The Problem with Selling

If a founder owns $1 billion in company stock and wants to buy a $50 million mansion, their instinct might be to sell $50 million worth of stock.

- The Consequence: Selling that stock triggers a “taxable event.” They would likely pay 20% in federal capital gains tax plus state taxes. To net $50 million, they might have to sell $80 million worth of stock. That is a $30 million loss to taxes.

The Solution: The 3-Step Process

Step 1: Buy (or Build)

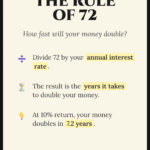

You acquire assets that appreciate in value over time. This could be equities (stocks), real estate, or a business. You hold these assets. As long as you do not sell them, the IRS generally does not tax the growth. You could have $100 million in “unrealized gains,” and your tax bill is $0.

Step 2: Borrow

Instead of selling the asset to get cash, the wealthy borrow against it.

- Securities-Backed Line of Credit (SBLOC): Banks will happily lend money using a portfolio of blue-chip stocks as collateral. Because the loan is secured by highly liquid assets, the interest rates are incredibly low (often close to the prime rate).

- The Magic: According to the tax code, loan proceeds are not income. You can borrow $50 million, and the IRS sees $0 in income. You pay no tax on that cash.

Step 3: Die

This sounds morbid, but it is a financial strategy. If you hold the assets until death, you utilize the “Step-Up in Basis” loophole (detailed in Part VI). Your heirs can sell the assets tax-free to pay off the loan, keeping the rest.

Pro Tip: This strategy requires discipline regarding “Loan-to-Value” (LTV) ratios. If the market crashes and the value of your collateral drops, the bank may issue a “margin call,” forcing you to sell assets at the bottom of the market to cover the loan. The ultra-wealthy rarely borrow more than 20% or 30% of their portfolio’s value to ensure safety.

Part III: Real Estate—The King of Tax Shelters

Real estate is perhaps the most protected asset class in the tax code. It offers a unique ability to generate positive cash flow while showing a “loss” on tax returns.

The Miracle of Depreciation

When you buy a rental property, the IRS views the building (not the land) as an asset that is slowly wearing out. They allow you to deduct a portion of the building’s value every year as an expense.

- Residential: Depreciated over 27.5 years.

- Commercial: Depreciated over 39 years.

The Scenario: You own an apartment building that generates $100,000 in net profit (rent minus expenses). However, your depreciation calculation says the building lost $100,000 in value this year.

- Math: $100,000 (Cash Profit) – $100,000 (Depreciation Expense) = $0 Taxable Income.

- Reality: You have $100,000 cash in the bank, but you tell the IRS you made nothing.

Advanced Move: Cost Segregation Studies

Sophisticated investors do not wait 27.5 years. They hire engineers to perform a “Cost Segregation Study.” This study breaks the building down into its components: carpeting, lighting, landscaping, and appliances.

- Many of these components can be depreciated over 5 or 7 years instead of 27.5.

- Combined with Bonus Depreciation (a rule that sometimes allows 100% deduction in year one), an investor might buy a $5 million building and write off $1.5 million in the first year, creating a massive tax loss that can offset other income.

Thing to Remember: Passive losses (from real estate) generally can only offset passive income. However, if you qualify as a “Real Estate Professional” (by spending 750+ hours a year managing property), you can use these paper losses to offset your active W-2 income. This is how high-income earners (like surgeons or attorneys) zero out their tax bills.

The 1031 Exchange: The Forever Deferral

When an investor finally sells a property, they should owe taxes on the gain. However, Section 1031 of the tax code allows them to roll 100% of the profit into a new, “like-kind” property (usually larger or more expensive).

- By doing this, the tax payment is deferred.

- Investors repeat this process for decades, swapping smaller buildings for skyscrapers, never paying a dime in capital gains tax, until they die (see “Step-Up in Basis”).

Part IV: Business Structures and “Expensing Your Life”

The wealthy rarely operate as individuals; they operate as corporations. Being an employee puts you on the defensive. Being a business owner puts you on the offensive.

The “Ordinary and Necessary” Rule

The tax code allows businesses to deduct expenses that are “ordinary and necessary” for the operation of the business. The wealthy are experts at characterizing lifestyle costs as business expenses.

- Travel: A vacation to Aspen is a personal expense. A board meeting held in Aspen, with documented minutes and strategy sessions, is a business expense. The flight, the hotel, and the meals become partially or fully deductible.

- Vehicles: Section 179 of the tax code allows businesses to write off the entire purchase price of heavy vehicles (over 6,000 lbs) in the year they are bought. This is why you see so many business owners driving G-Wagons or Range Rovers. It’s not just status; it’s a tax write-off.

The Augusta Rule (Section 280A)

This obscure rule allows a homeowner to rent their home to their own business for up to 14 days per year without reporting the rental income on their personal taxes.

- How it works: You hold a monthly board meeting at your house. Your business pays you a market-rate rental fee for the use of the space.

- Result: The business gets a tax deduction for the rent paid. You get the rental income tax-free. You have effectively moved money from a taxable bucket to a tax-free bucket.

Pro Tip: Documentation is everything. If you are audited, the IRS will ask for your “contemporaneous records.” You must have meeting minutes, calendars, and logs to prove the business purpose of these expenses.

Part V: Oil, Gas, and Green Energy

The government is desperate for domestic energy production. Consequently, the tax breaks for investing in energy are among the most aggressive in the code.

Intangible Drilling Costs (IDCs)

If you invest directly in an oil and gas working interest, you can deduct 70-100% of your investment in the very first year.

- Scenario: You earn $500,000 in W-2 income. You are facing a huge tax bill. You invest $100,000 into an oil drilling fund. You may be able to deduct that full $100,000 from your active income immediately.

- This is one of the few investments that allows “passive” losses to offset “active” W-2 income for high earners without needing to be a real estate professional.

Solar Credits

Investing in solar projects often yields a federal Investment Tax Credit (ITC). This is not just a deduction (which lowers taxable income); it is a credit (which lowers the tax bill dollar-for-dollar).

Part VI: The Estate Planning Endgame

The ultimate goal of the wealthy is not just to preserve money for themselves, but to create dynastic wealth that lasts for generations.

The Step-Up in Basis

This is the most powerful wealth-preservation tool in existence.

- The Concept: Capital gains tax is calculated on the difference between what you bought an asset for (your “basis”) and what you sell it for.

- The Mechanism: When you die, the tax basis of your assets is “stepped up” to their fair market value on the date of your death.

Example:

- Dad buys Apple stock in 1990 for $10,000.

- Dad dies in 2024. The stock is now worth $10,000,000.

- If Dad had sold it while alive, he would have paid tax on $9,990,000 of gain.

- Because he held it until death, the “basis” resets to $10 million.

- The heirs inherit the stock. They sell it immediately for $10 million.

- Tax Due: $0. The $9,990,000 in growth is erased from the tax system forever.

Trusts (GRATs and IDGTs)

To avoid the Estate Tax (a 40% tax on estates over a certain threshold, currently around $13 million per person), the wealthy use complex trusts.

- Grantor Retained Annuity Trust (GRAT): An individual puts assets into a trust that pays them an annuity for a set number of years. Any growth in the asset above a government-set interest rate passes to the heirs tax-free. This is how founders transfer billions to their children without triggering gift taxes.

Thing to Remember: Estate laws are fluid. The current high exemption for estate taxes is set to “sunset” (expire) in the coming years unless Congress acts. The wealthy are currently rushing to move assets into irrevocable trusts to lock in the current exemptions.

Part VII: The “Checkbook IRA”

Most people have a standard 401(k) or IRA invested in mutual funds. The wealthy often use Self-Directed IRAs.

The Peter Thiel Strategy

A Self-Directed IRA allows you to invest retirement funds in “alternative assets”—including private equity, real estate, or startup shares.

- If you put $5,000 into a Roth IRA (where growth is tax-free) and use that money to buy “founder shares” of a startup at $0.001 per share, and that company becomes a tech giant, the millions (or billions) in growth are 100% tax-free.

- Because it is a Roth, when you withdraw the money in retirement, the government gets nothing.

Summary: The Code is a Map

The difference between the wealthy and the middle class is often not just income, but financial literacy and utilization of the tax code.

The middle class views the tax code as a bill they must pay. The wealthy view the tax code as a rulebook for a game. If you follow the rules—invest in housing, produce energy, build businesses, and hold assets for the long term—the game rewards you with tax incentives.

5 Key Takeaways to Minimize Your Liability:

- Shift to Passive: Move as much income as possible from W-2 (highest tax) to Capital Gains or Passive Income (lowest tax).

- Don’t Sell, Borrow: Use SBLOCs or refinancing to access liquidity without triggering capital gains.

- Depreciate: Real estate is the most tax-efficient asset class due to depreciation and 1031 exchanges.

- Own a Business: Convert personal lifestyle expenses into legitimate business deductions where legal.

- Die with Assets: Utilize the Step-Up in Basis to wipe out generations of capital gains tax liability.

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, legal, or tax advice. The tax code is complex, subject to change, and highly dependent on your specific jurisdiction and situation. Attempting these strategies without a qualified CPA or Tax Attorney can lead to audits, penalties, and legal repercussions.